Wheee what a ride!

Wheee what a ride!

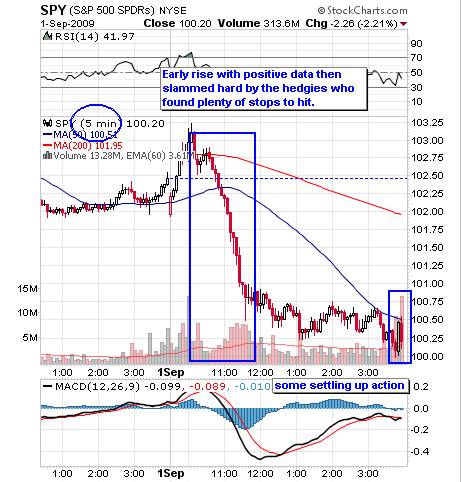

I don’t think we could have had a better day as the move up allowed us to place our bear plays (we went naked on our DIA $98 puts right at the top at 10 am) and the only fear we had was the morning data but by 10:10 I sent out an Alert to Members reviewing the bullish-looking data but then concluding: “Still this should give us a big boost with volume still light at 30M at 10am. Unless we break 9,600 with some authority, this should just be another shorting opportunity.” We were still concerned about good Auto Sales numbers boosting us back up but they were actually a series of disappointments all day long.

As David Fry points out in his morning post: “Most trading systems don’t have a “feel” component and mine doesn’t either. The only logical thing which we’ve commented on repeatedly as have others is light volume and how the news hasn’t jived with reality. And, recently, investors have been selling good news versus buying bad news as before.” This is why PSW always stresses the funamentals in stock trading. The market can trade against them for quite some time but, eventually, the true value will set you free (and often can make you a very nice profit!). I’ve had a very tough month in Augustpointing out the the news hasn’t “jived with reality” and suddenly we have gone from feeling overly conservative to being the only well-positioned people around – in cash, with plenty of winning puts and ready for another round of bottom fishing with the VIX right back at 30, which gives us exactly what we need to run our favorite plays.

We still have tons of cash in our $100,000 Portfolio and I’ll be initiating some buy/writes this week. I already propsed one for TTWO after last night’s earnings but now it looks like I’m not the only one who thought they looked pretty good and we’re not going to chase – there are, once again, plenty of fish in the sea! The last time we ran a Buy List was the week of July 6th and if you want to see what an actual list that goes 18 for 18 with an average upside of over 25% looks like, you can check that week’s wrap-up, which has a lot of good commentary for how we recognize a bottom. We will,…

We still have tons of cash in our $100,000 Portfolio and I’ll be initiating some buy/writes this week. I already propsed one for TTWO after last night’s earnings but now it looks like I’m not the only one who thought they looked pretty good and we’re not going to chase – there are, once again, plenty of fish in the sea! The last time we ran a Buy List was the week of July 6th and if you want to see what an actual list that goes 18 for 18 with an average upside of over 25% looks like, you can check that week’s wrap-up, which has a lot of good commentary for how we recognize a bottom. We will,…