There was a lot of news for the markets to digest this morning. The European Central Bank left their interest rate unchanged, and announced an “unlimited” bond buying program in an effort to fight the European debt crisis. In the U.S., the ADP Employment Report came in at 201,000, well above an expected 149,000-151,000 range. Jobless claim posted their lowest number in a month, coming in at 365,000, down 12,000 from the prior week. The combined data is a good sign for a bullish move ahead of tomorrow’s release of the U.S. employment report.

MORNING ACTION

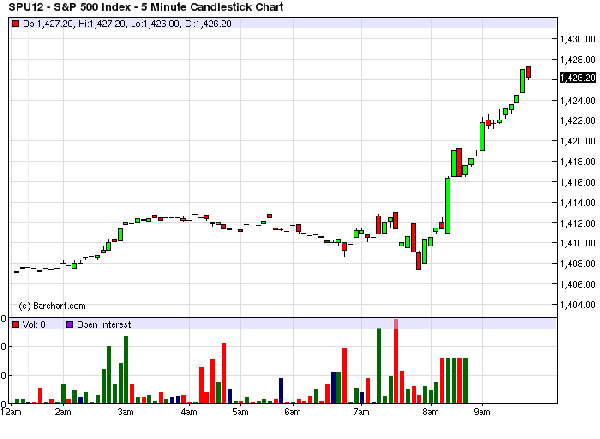

The September E-Mini S & P (ES) traded above recent resistance level 1420. Traders appear to be buying into this market with a bit more confidence possibly supported by the good job numbers. Look for a continued push up to 1430 on an intraday level. We are in new territory in the ES for the year, and traders should be cautious ahead of tomorrow’s numbers. The market is breaking out of the tighter range we have seen over the last few weeks.

SHORT-TERM PLAY

I like going long in the 1420-1422 range, with an exit near 1429-1430. If the market does trade above the 1430 mark, look for new resistance coming in near 1434.

My floor trader instinct does not allow for me to take positions into tomorrow’s release from Bureau of Labor and Statistics, so I am looking for a short term play.

Looking for more trading ideas? Check out the Markets on the Move section here.

THERE IS A SUBSTANTIAL RISK OF LOSS IN FUTURES AND OPTIONS TRADING. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THE USE OF A STOP-LOSS ORDER MAY NOT NECESSARILY LIMIT YOUR LOSS TO THE INTENDED AMOUNT. CURRENT EVENTS, MARKET ANNOUNCEMENTS AND SEASONAL FACTORS ARE TYPICALLY BUILT INTO FUTURES PRICES. A MOVEMENT IN THE CASH MARKET WOULD NOT NECESSARILY MOVE IN TANDEM WITH THE RELATED FUTURES AND OPTIONS CONTRACTS.