In the world of credit cards, American Express is a big name. I just wish they never gave the United States of America its own card with an unlimited credit limit. I mean at least cut us off at 20 trillion. Do we get any airline points with our spending?

All joking aside, it’s also a fun stock to trade for both fundamental and technical traders.

THE SETUP

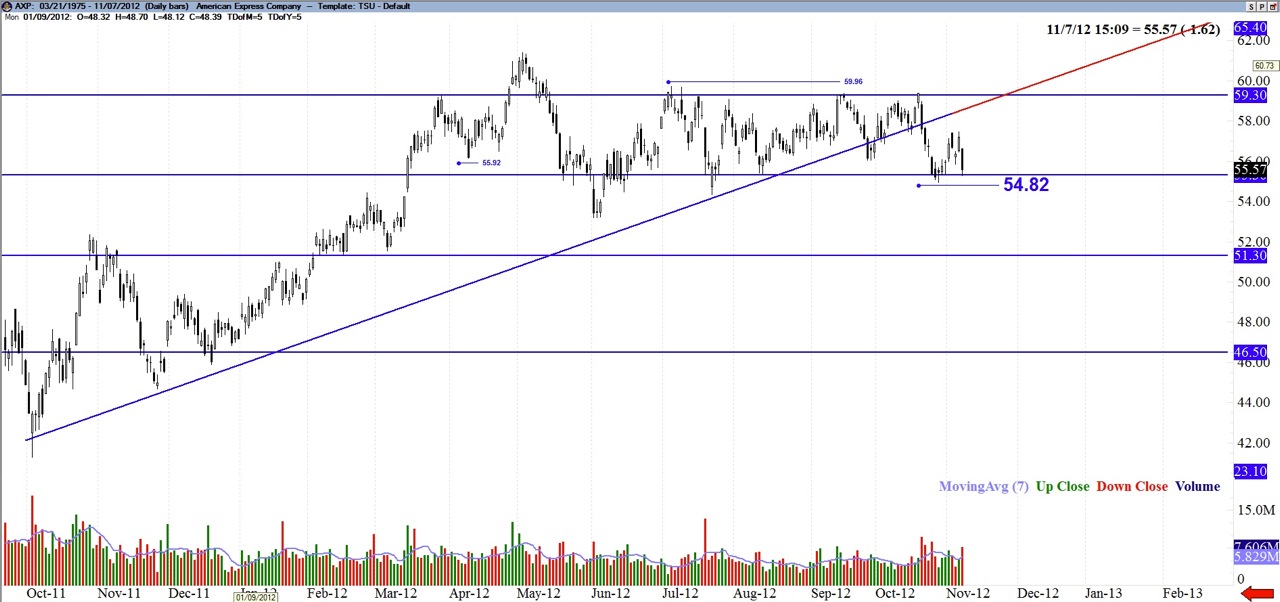

American Express (AXP) has a nice bullish trend line beginning in September 2011. We have recently broken that as we consolidate between $60 and $55. I think my “good friend” Charles Dow would agree that this could be a distribution phase in the overall trend of AXP…and where there is distribution, there could be continued selling.

THE TRADE

We do have a strong support around $55, so if we get a solid close below $54.82, I feel a bearish perspective would be most probable down to the $51 area.

A CAUTION

Keep in mind that if we do break below this support area, we would likely come back up to test the support from the bottom – remember, old support will become new resistance. If you buy puts, make sure you have enough time on them.

FOR STOCK HOLDERS

If you own at least 100 shares and we do break below support, this would be a great time to sell covered calls. At the same juncture, if we bounce off of support (which is why a close below support would be a probable bearish trade), one could take a long position on the stock up until the $60 resistance area. If this happens again, and it’s happened many times in the past, then one could sell the $62.50 call and bring in a nice premium.

Read more trading ideas here.