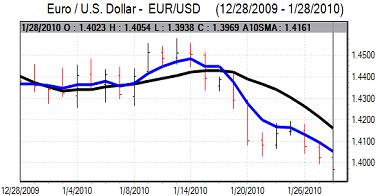

EUR/USD

There was sharp Euro selling pressure in Asia on Thursday with stop-loss selling pushing the currency to lows below 1.3950 before a rally back to 1.40.

Underlying confidence in the Euro-zone economy remained weak amid persistent fears over the debt outlook. Comments from senior European officials have been unable to stem the mood of pessimism and have also maintained a lack of confidence in the Euro.

The US economic data was generally slightly weaker than expected. Jobless claims only declined to 470,000 in the latest week from a revised 478,000 previously. Headline durable goods rose 0.3% for December which was well below consensus expectations while there was a 0.9% underlying increase for the month.

The data will reinforce expectations that there will be a very slow increase in interest rates at best over the next few months and this will curb dollar support on yield grounds.

Fed Chairman Bernanke was confirmed for a second term in a Senate vote on Thursday which will ease market uncertainty over the Fed situation and provide some degree of relief. There should also be some improvement in risk appetite which may provide some degree of Euro support.

Nevertheless, the Euro hit further selling pressure above 1.40 and dipped to re-test lows below 1.3950 before stabilising later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Confidence in the Japanese government-debt situation remains weak and this will continue to undermine scope for yen support in the medium term. Risk appetite managed to stabilise on Thursday with some reassurance following Obama’s state of the union address which also curbed immediate yen demand, although conviction was low.

The dollar was able to stabilise above the 90 level in early Europe with the Japanese currency still able to resist substantial selling pressure as caution surrounding the global economic trends persisted.

The US dollar continued to find some degree of support below the 90 level, but was unable to make significant headway.

Sterling

A lack of confidence in other European economies and the Euro was still important in providing support for the UK currency during Thursday with Sterling advancing back to test resistance levels above 1.62 against the dollar.

There were no significant economic data releases during the day which curbed activity to some extent. The movements in equity prices were significant and the UK currency came under some selling pressure as the UK market weakened in afternoon trading.

Given doubts over capital inflows, there will be continuing sensitivity to movements in equity prices. Sterling dipped to lows near 1.61 against the dollar while the Euro found support near the 0.86 level.

Swiss franc

The dollar maintained a firm tone during Thursday and pushed to re-challenge resistance levels above the 1.020 level. The US currency was unable to break above this region and edged marginally lower later in the US session. The dollar was hampered to some extent by a firm franc tone on the crosses as the Euro dipped back below the 1.47 level.

The franc will continue to gain some defensive support if risk appetite remains generally weaker. There will be additional pressure for National Bank intervention if the Euro sustains a move below 1.47 against the franc

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

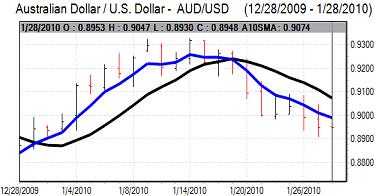

Australian dollar

Risk appetite managed to stabilise during Thursday and this pushed the Australian dollar back to above the 0.90 level against the US currency in early Europe.

Overall, the Australian currency will find it difficult to make further significant headway in the short term, especially with a less confident tone surrounding global risk appetite and it retreated back to below the 0.8950 level later in the US session.