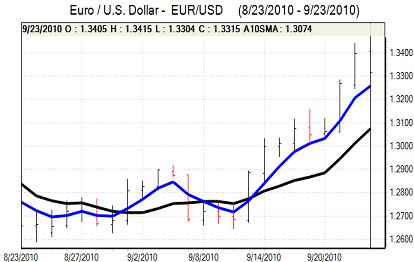

EUR/USD

The Euro maintained a firm tone in Asia on Thursday and consolidated close to 1.34 against the dollar with only limited corrections weaker, but the currency did prove to be more vulnerable during the European session.

The flash Euro-zone PMI manufacturing index fell to 53.6 for September from 55.1 the previous month. The services-sector reading was at the same level which reinforced fears over a significant slowdown in the Euro-zone economy, especially with a sharp slowdown in the German economy.

Confidence in the economy was also undermined by much weaker than expected Irish second-quarter GDP data. There was a renewed 1.2% contraction over the three-month period, contrary to expectations of a modest increase. The data triggered a further widening of credit-default swaps and also undermined confidence in the Euro, especially as there was fresh speculation over a default on Irish bank debt which maintained wider fears over the European banking sector.

The US jobless claims data was weaker than expected with a rise to 465,000 in the latest week from a revised 453,000 previously. The existing home sales data was slightly stronger than expected with a rise to 4.13mn for August from a revised 3.84mn previously, but this only recovered part of the sharp decline to 13-year lows seen for July.

Underlying confidence in the economy remained weak and this also continued to undermine yield support for the US currency. The Euro weakened to a low near 1.33 and rallies met selling pressure with consolidation near 1.3330 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Despite some speculation over Bank of Japan intervention, trading conditions proved to be very subdued in Asian trading on Thursday with several Asian markets closed for market holidays. There was no central bank action and the US currency was unable to secure any buying support.

Ranges remained narrow over the remainder of Thursday with the dollar trapped between a lack of buying support and an unwillingness to sell the US currency due to the threat of intervention.

The US currency secured minor gains following the US housing data, but was still undermined by a lack of yield support and was still below 84.50 in New York.

Sterling

Sterling remained under pressure in early Europe on Thursday and re-tested support near 1.56 against the dollar.

The UK economic data was again weaker than expected with mortgage approvals falling to the lowest level since April 2009 which reinforced fears over the housing sector and maintained unease over the UK economy.

There were mixed comments from Bank of England MPC members with Dale, for example, stating that the economy faced major headwinds. There will be further speculation that the central bank will adopt further quantitative easing within the next few months, but the situation will certainly be complicated by the fact that there will be important concerns over the inflation outlook.

The overall policy mix is likely to remain unfavourable for Sterling, especially given the fiscal tightening, but selling pressure is likely to be contained by weak confidence in the dollar and Euro-zone.

Sterling rebounded to below 0.85 against the Euro due to renewed fears over the Euro-zone financial sector and also tested resistance levels above 1.57 against the dollar before settling just below this level.

Swiss franc

The Euro was blocked close to 1.3250 against the franc during Thursday and weakened steadily to lows near 1.31 during the European session. There was fresh defensive demand for the Swiss currency following the Irish banking-sector fears as yield spreads within the Euro-zone widened.

The dollar was unable to make any progress in this environment and dipped to fresh 30-month lows near 0.98.

The Swiss currency will continue to gain support form an underlying lack of confidence in the Euro-zone financial sector.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

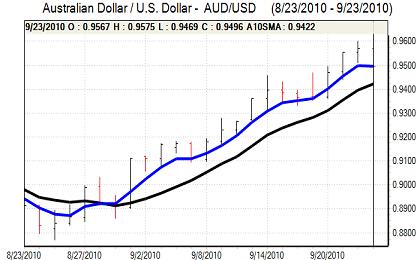

Australian dollar

The Australian dollar was unable to make a renewed challenge on the 0.96 level against the US currency during Thursday and weakened to lows below 0.9480 before finding some support.

The currency was vulnerable to a correction following recent gains and international risk appetite was slightly more fragile. There will also be further doubts surrounding the global economy and this will make it more difficult for the Australian dollar to regain momentum. For now, selling pressure is still likely to be limited.