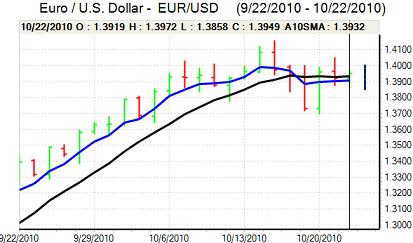

EUR/USD

The dollar continued to find support weaker than 1.40 against the Euro during Friday and generally consolidated just weaker than 1.39. With further G20 meetings during the weekend, there was a reluctance to take on additional positions which curbed activity and there were no major US economic data releases.

At the G20 meetings, the communiqué pledged that countries would seek to avoid competitive devaluations while exchange rates should be set by markets. The comments reinforced market speculation that there was no agreement for more decisive action on currency co-operation which also lessened any expectations of co-ordinated intervention and tended to undermine the dollar.

The dollar weakened to lows beyond 1.40 against the Euro in Asian trading on Monday with US selling still seen as the path of least resistance. Short speculative dollar positions remain at a very high level which may provide some degree of protection for the dollar.

Federal Reserve policies will also remain a key focus in the short term as markets ponder the scope of any further quantitative easing by the central bank. There are strong expectations that there will be further action in November, but the size of any bond purchases remains uncertain. In this context, comments from Chairman Bernanke will remain under close scrutiny with further remarks possible in a speech due to be made on Monday. The dollar will gain some relief if Bernanke indicates that quantitative easing could be less than expected.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained trapped in relatively narrow ranges on Friday as support close to 81 against the yen held, but there was no interest in pushing the US currency stronger.

The latest Japanese trade data showed a slowdown in annual export growth for the seventh successive month which will maintain internal pressure for competitiveness to be maintained.

The G20 meetings, however, suggested that the Bank of Japan and Finance Ministry would find it more difficult to secure international support for aggressive intervention and the markets considered that the net chances of Bank of Japan action had declined which boosted the yen.

In this environment, the dollar was subjected to further selling pressure in Asia on Monday and was struggling to sustain a position above the 81 level.

Sterling

Sterling edged lower against the dollar on Friday as there was a further move to challenge support with a move to test important levels close to 1.5650. The UK currency rebounded to above 1.57 on Monday, primarily due to a renewed deterioration in the dollar with Sterling at 7-month lows beyond 0.89 against the Euro.

There will be further expectations of a slowdown in the UK economy with indicators of business confidence of particular importance in the short term. Any sign of deterioration would increase pressure for additional quantitative easing at by the Bank of England.

Although related to past growth, the third-quarter GDP report will also be important for Sterling sentiment on Tuesday and the currency will be vulnerable to renewed selling pressure on a weaker than expected report. Any figure above 0.6% for the quarter would provide immediate relief for the currency.

Expectations of further Fed quantitative easing and an improvement in risk appetite should also provide some significant Sterling protection.

Swiss franc

The franc weakened significantly on the crosses during Friday and this trend continued on Monday with the Euro advancing to a high above 1.3650. Cross-related weakness allowed the dollar to hold above the 0.97 level against the franc despite its own vulnerability.

The franc will tend to lose some support if there is sustained decline in expectations of global market tensions surrounding exchange rates and the latest export-growth data also increased speculation that the economy could be slowing. In this context, there were suspicions that the National Bank was quietly encouraging the Swiss currency to weaken further.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

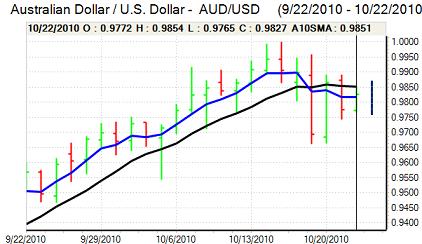

Australian dollar

The Australian dollar maintained a solid tone on Friday, finding support below the 0.98 level against the US currency before advancing in US trading. There were further robust gains on Monday with a peak above the 0.9920 level as risk appetite was generally firmer.

The Australian dollar also gained support from relatively hawkish comments from Reserve Bank Governor Stevens which increased speculation over a further interest rate increase at the November central bank meeting. A stronger than expected increase in producer prices also increased expectations over higher interest rates. Volatility is likely to remain a key short-term market feature.