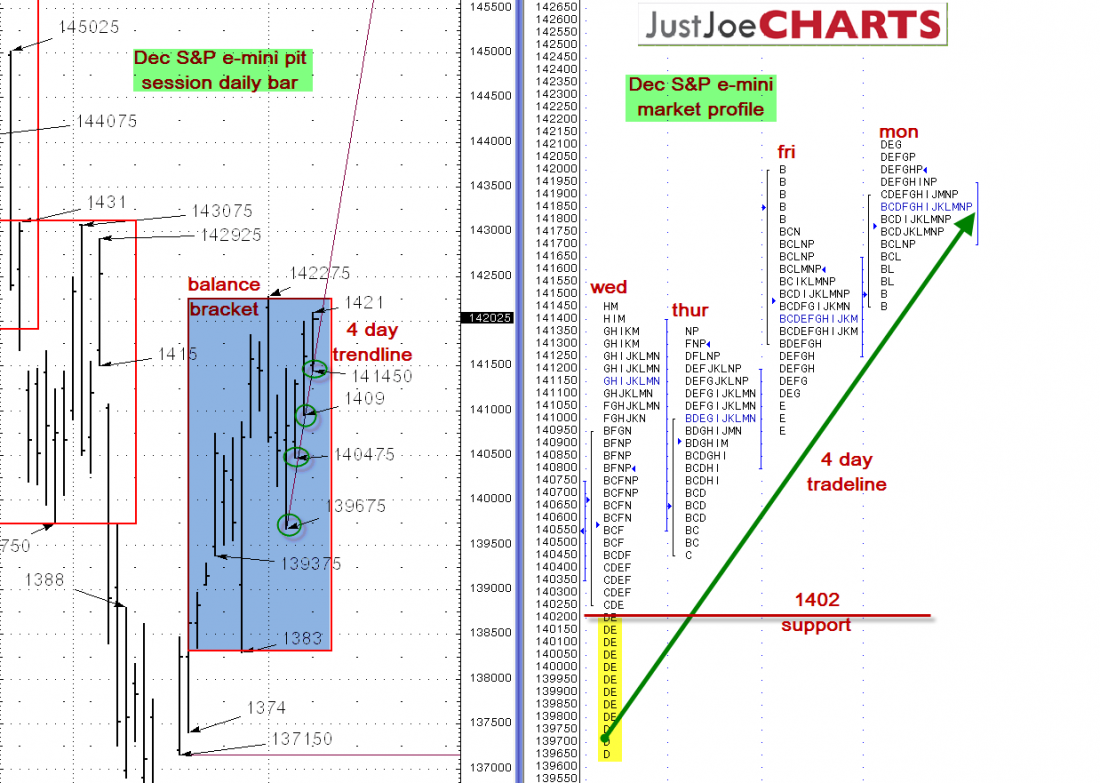

The December S&P E-mini contract has been trading within a 1383 to 1422.75 balance bracket for the last three weeks.

On Monday, the high of the day came within 2 ticks of the 1422.75 balance bracket high. Additionally, the market is trading along a 4 day trendline, slightly raising value each day.

SHORT TERM TRADERS CONTROL THE MARKET

Many times, when a market has daily lows, slightly higher than the previous day for several days in a row, it is an indication that the short term traders are controlling the market, as opposed to long term bank/hedge fund traders.

This pattern can continue for several days, however during that time, the short term traders are building a long position. If the market finally breaks the trendline, it could cause a long liquidation break.

Additionally, the market is testing the 1422.75 balance bracket high. If the market gains acceptance above that level, it could accelerate higher.

BREAKING THE TRENDLINE

If the market breaks the trendline, it could cause the short term traders to begin to cover their long positions, causing a long liquidation break. 1402 is a level where a the market could find support.

BREAKING FROM BALANCE TO THE UPSIDE

If the market gains acceptance above the 1422.75 balance bracket high, it may test the 1429.25 barchart reference.

= = =