Commodities have been taking a beating lately and precious metals have been unable to escape the wrath of the bears.

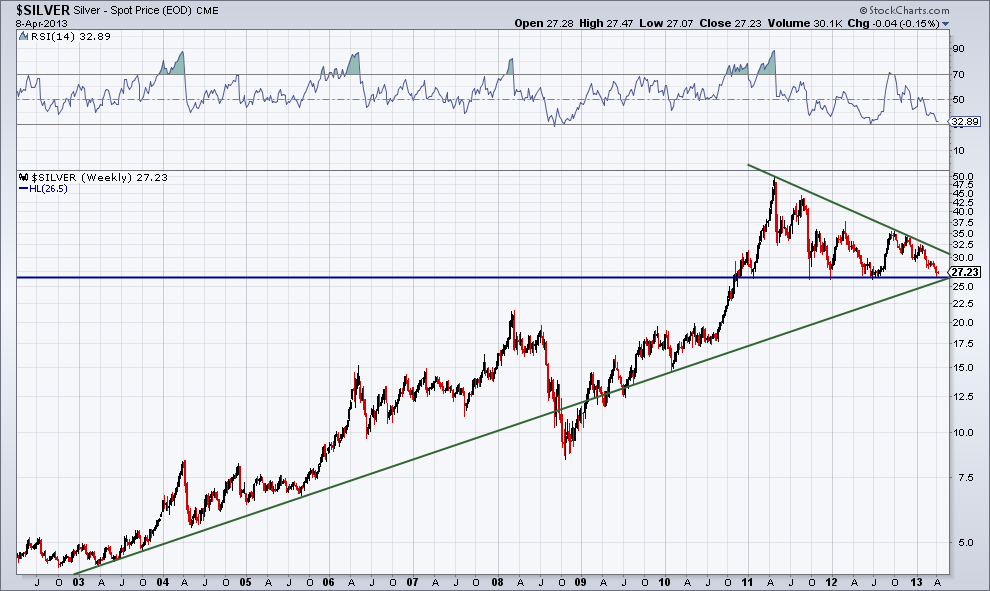

Back in January I wrote a piece outlining the weakness taking place in silver. Momentum was falling and a triangle pattern had been created. It didn’t take long for the bearish momentum to win out and silver fell through its rising trend line, taking it down to the lows of last year.

BIG PICTURE

The precious metal has now fallen to previous support created in 2011 and 2012. If we take a step back and look at a weekly chart we can see that silver is approaching a rising trend line that was created back in 2003. During the financial crisis of 2008 the commodity was unable to hold the line but regained it in 2010, right before silver rose from $15 to $50. This rising trend line has created a large triangle with the falling trend line off the 2011 high. If support holds then there’s a chance we test resistance near $30.

IS IT A FALLING KNIFE?

Going back to 2003 we have only see the Relative Strength Index (RSI) become oversold (breaking below 30) twice on a weekly chart, first during the low in ’08 and again last year. We aren’t quite there yet with the RSI sitting just under 33. Silver bulls might get an oversold rally off the previously mention support if the indicator continues to weaken. Presently the commodity may still be considered a ‘falling knife’ while it continues making lower lows. Going forward we’ll see if silver is able to consolidate at the 2012 low or if the multi-year trend line comes in to play as possible support.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.