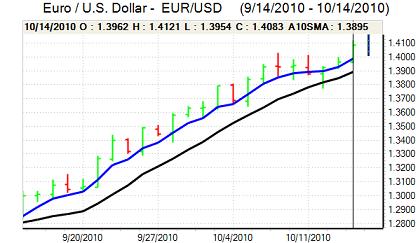

EUR/USD

The dollar was subjected to renewed and heavy selling pressure in Asia on Thursday and weakened to a nine-month low as the Euro broke through the 1.40 resistance zone following a monetary tightening in Singapore. The break higher triggered stop-loss Euro buying and it accelerated to a high around 1.4120 during the European session.

There were no major comments from senior Euro-zone officials about the Euro’s value, but markets will remain on high alert over verbal intervention after the comments from Juncker last week that the Euro was too strong at 1.40 against the dollar.

The US economic data was slightly weaker than expected with jobless claims rising to 462,000 in the latest week from a revised 449,000 previously. The August trade deficit was also higher than expected with a rise to US$46.3bn from US$42.6bn the previous month while producer prices rose 0.4%.

The data overall will maintain expectations that the Federal Reserve will push towards further quantitative easing at the November FOMC meeting. In this context, markets will closely monitor comments from Fed officials with Chairman Bernanke due to speak again on Friday. If Bernanke does take a more cautious stance on possible quantitative measures, then there could be an important re-assessment of sentiment.

There was a slightly more cautious tone towards risk appetite in US trading and the Euro was prone to profit taking with a retreat back towards the 1.4050 level before finding fresh buying support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen strengthened sharply in Asian trading on Thursday as there were wider gains for Asian currencies. The latest market moves were triggered mainly by a monetary tightening by the Singapore Monetary Authority as they stated that the currency would be allowed to gradually strengthen within a wider trading band. The move strengthened market speculation that there would be underlying appreciation for Asian currencies and also triggered renewed speculative dollar selling.

The dollar weakened to lows below 81.20 and the Bank of Japan will be under increased pressure to sanction renewed intervention to deter yen momentum buying and keep US selling pressure under control.

The US data did not provide any support to the US currency, but there was support close to 81 and the dollar rallied to the 81.50 area. Prime Minister Kan stated that the authorities would take decisive action if necessary which maintained speculation that there could be fresh intervention.

Sterling

Wider dollar selling remained a key influence in Asian trading on Thursday and allowed Sterling to challenge important technical resistance near 1.60 against the dollar. As the US currency remained under pressure, the UK currency pushed to an eight-month peak above 1.60.

There were no UK economic releases during the day with monetary and fiscal policies remaining an important focus. The government will announce details of spending reductions next week and there will be further speculation that the measures will help trigger a sharp slowdown in the economy.

There will also be further speculation that the Bank of England will move towards additional quantitative easing. In this context, comments from MPC members will be watched very closely in the short term.

Sterling found it difficult to sustain the move above 1.60 and dipped slightly below this level during the US session with the UK currency finding some support beyond 0.88 against the Euro.

Swiss franc

The dollar was subjected to renewed selling pressure during Thursday and weakened to fresh record lows below 0.9480 against the Swiss franc. The Euro also found it difficult to hold above 1.34 against the Swiss currency despite overall gains.

Expectations of further quantitative easing by the Federal Reserve and increased speculation that other countries will push for weaker currencies continued to provide underlying support to the Swiss currency. Markets will, however, also remain on high alert over the possibility of National Bank opposition to rapid franc gains even though there will be expectations that the bank will strongly defend longer-term currency value.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

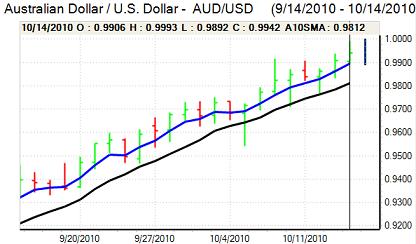

Australian dollar

Commodity prices remained strong on Thursday and there was wider selling pressure on the US currency which helped push the Australian dollar to a high around 0.9990 against the US unit. Momentum will be a very important near-term factor and Australian dollar sentiment will remain very strong.

Expectations of rising commodity prices and US quantitative easing will also tend to boost the Australian currency, but the currency remains over-bought on a short-term view.

The Australian dollar hit resistance close to parity and weakened back to the 0.9920 level as there was an important round of profit taking.