EUR/USD

The Euro found support below 1.3650 against the dollar in Europe on Wednesday and strengthened to highs above 1.3750 as Europe closed. There was some relief over the Greek situation as the government pledged to strengthen austerity measures through spending cuts with reductions in public-sector wage costs a key focus. There were still major concerns whether the government would be able to deliver the austerity measures given the extent of internal divisions and popular discontent.

There were also continuing fears surrounding the banking sector as underlying stresses persisted. The IMF estimated that at least EUR200bn in fresh capital needed to be raised and there were persistent doubts surrounding the French banks in particular. There were also rumours that Austria could face a credit-rating downgrade due to the heavy burden of credit derivatives within the banking sector.

Attention returned to the Federal Reserve later in the US session with the latest FOMC statement. In broad terms, the Fed met market expectations with the announcement of ‘operation twist’. The Fed will buy US$400bn in longer-dated securities in the period until mid 2012 through the selling of shorter-term securities. The Fed also announced that it would target mortgage-backed securities in an attempt to keep mortgage rates down.

There was no introduction of further quantitative easing at this stage with the Fed keeping all policy options open as it remained generally downbeat on the economic situation. Three FOMC members dissented from the decision, as had been the case at the previous meeting

Equity markets fell sharply following the FOMC meeting and this also triggered a sharp deterioration in risk appetite which pushed the dollar sharply higher. The Euro dipped to lows below 1.3550 as the dollar index pushed to an eight-month high. The US currency also gained support from a further shift of funds out of emerging markets.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 76.20 against the yen on Wednesday and pushed higher in US trading. The US currency gained wider support which helped underpin it against the yen, while there were significant technical developments as the yen retreated from over-bought levels against the Euro.

The US existing home sales data was stronger than expected at 5.03mn for August. It will still be difficult for the dollar to gain any significant support on yield grounds, especially with the Fed acting to keep long-term interest rates down.

There was also further defensive demand for the yen, especially as Asian equity markets remained firmly on the defensive. The US currency consolidated below the 77 level with exporter selling also increasing on any move towards this level.

Sterling

Sterling was unable to make any significant progress above 1.57 against the dollar on Wednesday and was subjected to heavy selling pressure during the day on a combination of international and domestic influences.

The Bank of England minutes recorded a 9-0 vote for unchanged interest rates at the September MPC meeting and there was an 8-1 vote for quantitative easing to be held at GBP200bn as Posen again voted for an expansion.

The bank was generally pessimistic over the economic outlook and several members did move towards voting in favour of additional quantitative easing. There were, however, important reservations over announcing fresh easing when inflation was so far above the 2.0% target.

Markets concluded that further quantitative easing was likely over the next few meetings and this pushed Sterling sharply weaker. The latest government borrowing data was weaker than expected at GBP13.2bn for August, although the impact was cushioned by the fact that there were downward revisions to previous data. There was further pressure for the government to slow fiscal tightening given the deteriorating economic outlook.

Sterling dipped to fresh 8-month lows below 1.55 against the dollar and was also weaker than 0.8750 against the Euro.

Swiss franc

The dollar found support below 0.89 against the franc on Wednesday and secured renewed gains in the US session with a challenge on levels above 0.90 for the first time since the middle of April.

The Euro was able to hold above 1.22 against the Swiss currency despite vulnerability elsewhere. There was further speculation that the National Bank would push for a higher 1.25 minimum level against the Swiss currency.

The general slide in the Euro will dampen immediate pressure for further central bank action with the Swiss banking sector still an important focus.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

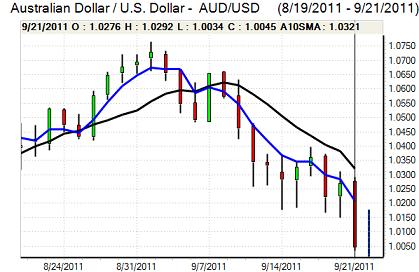

The Australian dollar again hit resistance on moves towards 1.03 against the US dollar on Wednesday and retreated back to the 1.02 area late in the European session even though the Euro was generally stronger.

The currency was subjected to further heavy selling pressure in Asia on Thursday as it tested parity for the first time since early August.

Global risk appetite was significantly weaker following the Fed statement which undermined confidence in the Australian currency, especially with persistent weakness in Asian currencies. There was also disappointment following the Chinese PMI data as industrial commodity prices were also subjected to further selling which hurt the Australian currency.