The S&P 500 is poised just below all-time highs. While there is plenty of chatter about potential negative market forces, we may be on the verge of a strong bull run.

Click here to watch a video explaining how to read markets using volume at price.

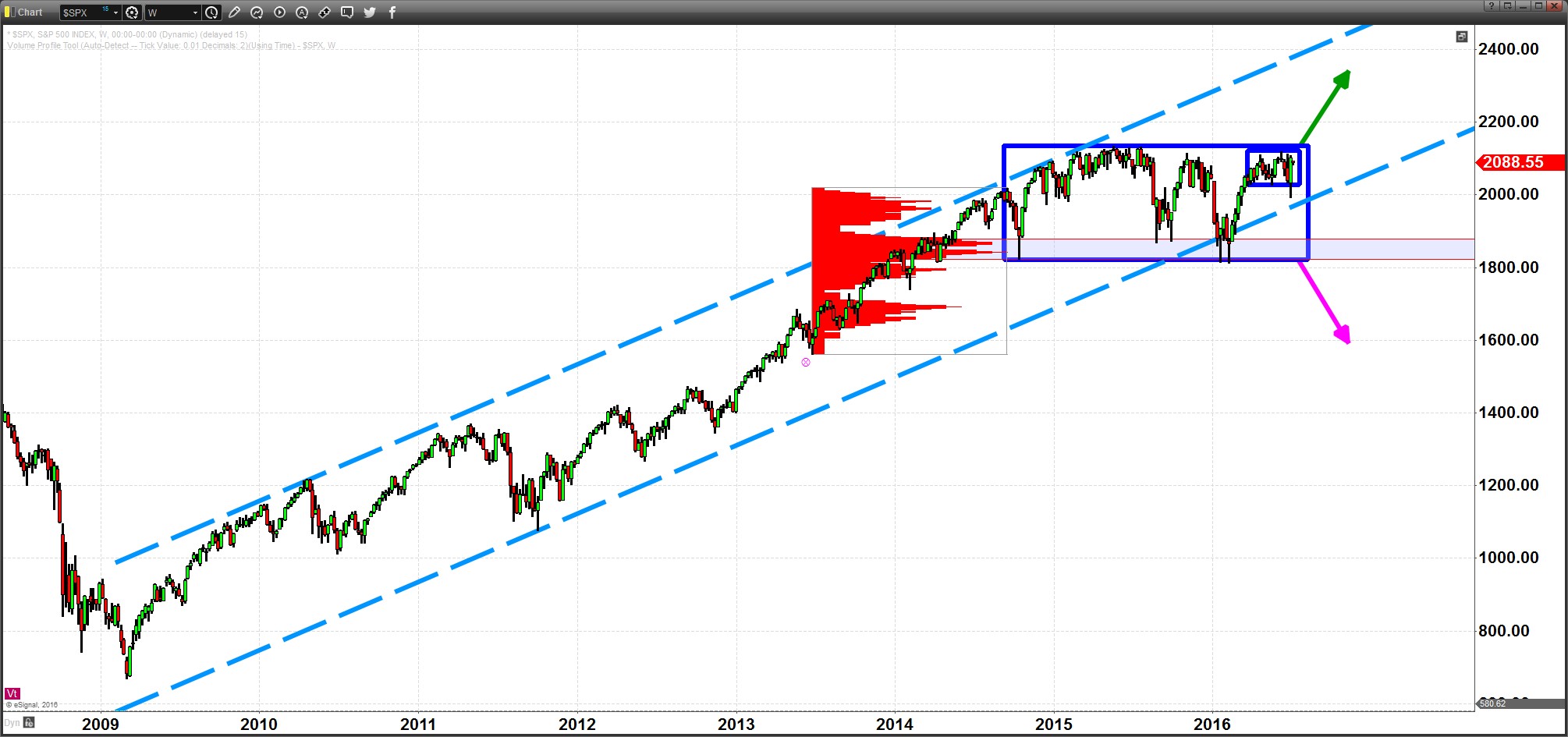

The break lower in the SPX immediately following the Brexit vote was a false breakdown of a 3-month consolidation (small blue rectangle). The rip back to the upside squeezed breakdown shorts that became stuck after the index recovered inside the range.

In the larger context, we have been in a large balance/rotation for more than a year (large blue rectangle). The move higher from the January low was a successful hold of the bottom of this range.

The move off the January low was a straight line run to the top of the range with no pause, which left it extremely extended and overbought as it reached the highs, making it ripe for a decent pause or pullback, which has occurred.

The false breakdown was bullish in the near-term and brought the SPX back to the area of the highs. This is amid a bullish leg up from the January low, which only partially retraced its straight-line run. We are in the top half of an 18-month balance that is amid a big, big picture bullish move from the lows of 2009 (this 18-month balance did not retrace much of that run). So to be perfectly objective, that is a lot of bullish factors/signals.

Despite any global or geopolitical concerns, this expanded view of the big picture would turn exceedingly bullish upon a breakout higher. An upside resolution of this 18-month balance/rotational range to the upside would put all time frames and patterns into alignment to the upside.

The Nasdaq and Russell are lagging behind the S&P in their big picture positions and they would need to eventually confirm and participate in any big picture bullish breakout. That said, the bullish context of a break higher to new all-time highs in the SPX cannot and should not be discounted.