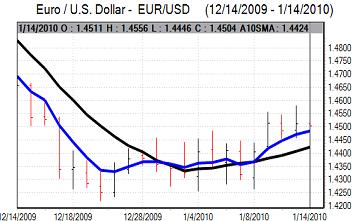

EUR/USD

The Euro again hit resistance above the 1.4550 level against the dollar in early Europe on Thursday and drifted back to the 1.45 region ahead of the ECB interest rate decision

As expected, the central bank held interest rates at 1.0%. In the statement following the meeting, President Trichet again commented that interest rates were at appropriate levels and that the risks to growth were broadly balanced.

Trichet stated that it was absurd to speculate that any country could be forced to leave the Euro area, although he was still reluctant to make substantive comments on the situation surrounding Greece’s government debt position.

Underlying confidence remained weak and the Euro was unsettled by comments from German Chancellor Merkel who stated that the Greek budget situation risked damaging the Euro.

The headline US retail sales data was weaker than expected with a December decline of 0.3% compared with expectations of a small increase. Although the November figure was revised up, the data will create some doubts over spending trends. Following recent mixed comments from Fed officials, there will still be doubts over the potential for an early increase in interest rates with markets putting a 30% chance of a rate increase by the June meeting.

The jobless claims data was also slightly weaker than expected with an increase in initial claims to 444,000 in the latest week from a revised 433,000 previously. The data can be distorted by holidays around this time of the year and the underlying claims data still indicates an underlying improvement.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The latest Japanese machinery orders data was sharply weaker than expected with a substantial decline of 11.3% for November which pushed the series to a record lows since the data started in 1987 and undermined confidence.

The data will increase fears over the economy and maintain pressure for the Bank of Japan to provide additional support to the economy. There will also be additional pressure for the authorities to weaken the currency.

Risk appetite was generally firmer on Thursday following the Australian employment data and this also undermined the yen to some extent. The dollar was able to move to 91.70 against the yen as Finance Minister Kan stated that currency rates should be set by markets unless there are rapid moves.

The dollar pushed to a high near 92 against the yen, but lost ground following the US economic data and retreated to the 91 area

Sterling

Sterling maintained a firm tone on Thursday, challenging 1-month highs against the dollar above the 1.63 level while the UK currency also strengthened through 0.89 against the Euro.

The UK currency continued to gain some support from slightly more hawkish rhetoric from Bank of England MPC members which has also triggered speculation over an earlier than expected increase in UK interest rates.

Sterling is also continuing to draw some support from a lack of confidence in the Euro. There will still be a high element of concern over the UK economy which will limit the scope for further buying support, especially given the very high debt situation.

Swiss franc

The dollar resisted a further test of support below 1.0150 against the franc on Thursday and pushed to a high around 1.0230. The dollar, however, was again unable to hold a position above 1.02 during the day.

The Euro secured a net advance against the franc and consolidated around the 1.48 region in early US trading before weakening again later in the US session as underlying support for the currency remained weak.

The ECB press conference has not eased fears surrounding the Euro-zone economy and these uncertainties will tend to limit any selling pressure on the Swiss franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

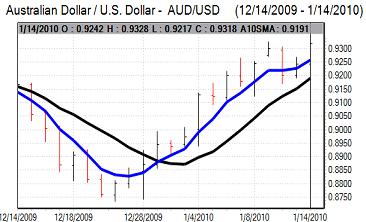

Australian dollar

The Australian dollar pushed higher in local trading on Thursday. The labour-market data was again stronger than expected with an employment increase of over 35,000 for December compared with expectations of a 10,000 increase.

The data will reinforce optimism over thee economy and speculation over further interest rate increases within the next few months. The Australian currency attacked resistance levels above 0.93 against the US dollar and was able to consolidate above this level later in New York.