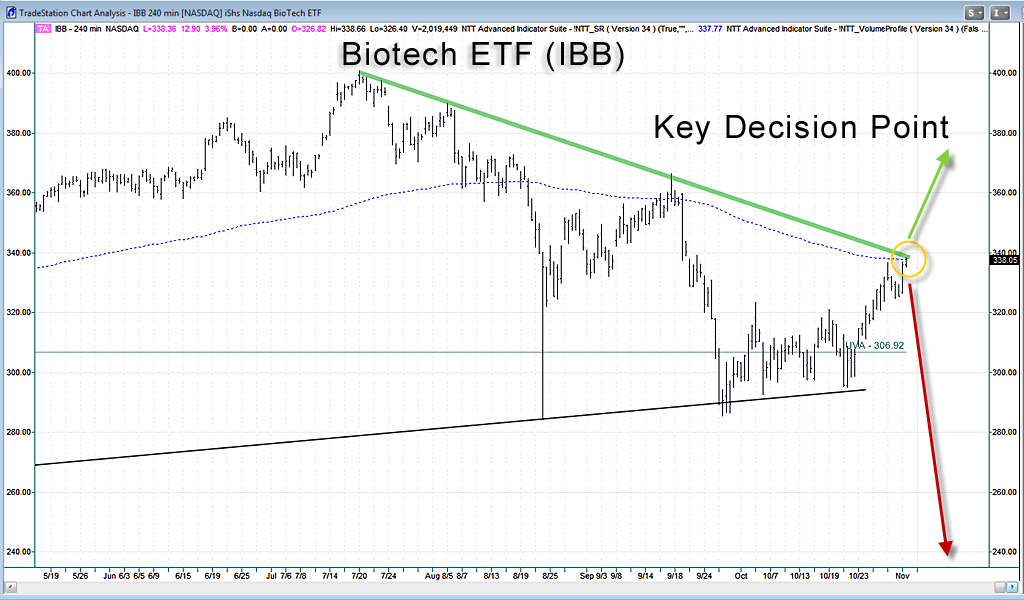

I’ve been tracking the technicals for the biotech sector, which has been notably lagging the rest of the market. The Nasdaq Biotech ETF (IBB) is my reference ETF for the sector, as it is the volume leader in the biotech ETF space.

Although the Nasdaq 100 made a new multi-year high on Monday and despite relatively light volume wants to head even higher, IBB is at a critical decision point and I have my doubts as to whether the Nasdaq can fulfill its dream of new all-time highs without the participation of IBB.

IBB is up against an obvious downtrend line, as well as the 200 ema (blue dotted line) and some volume resistance mentioned in earlier articles. I think we have two potential scenarios and one will be selected this week.

Scenario #1) IBB breaks out and heads higher to 365. This supports the continuing rally in the QQQ.

Scenario #2) Biotech breaks down and catalyzes a surprise correction in the Nasdaq 100 as IBB drops to $250.

I was favoring the more bearish outcome last week, but with the S&P 500 acting so darn well, I have to give the benefit of the doubt to the bulls.