OK, I’m going to say it: Two really big-name stocks have been kind of boring lately.

General Motors (GM) and Ford (F) haven’t really knocked my socks off when it comes to fun directional trades. Both of these stocks are sideways at the moment, folks. Don’t try to force anything fancy.

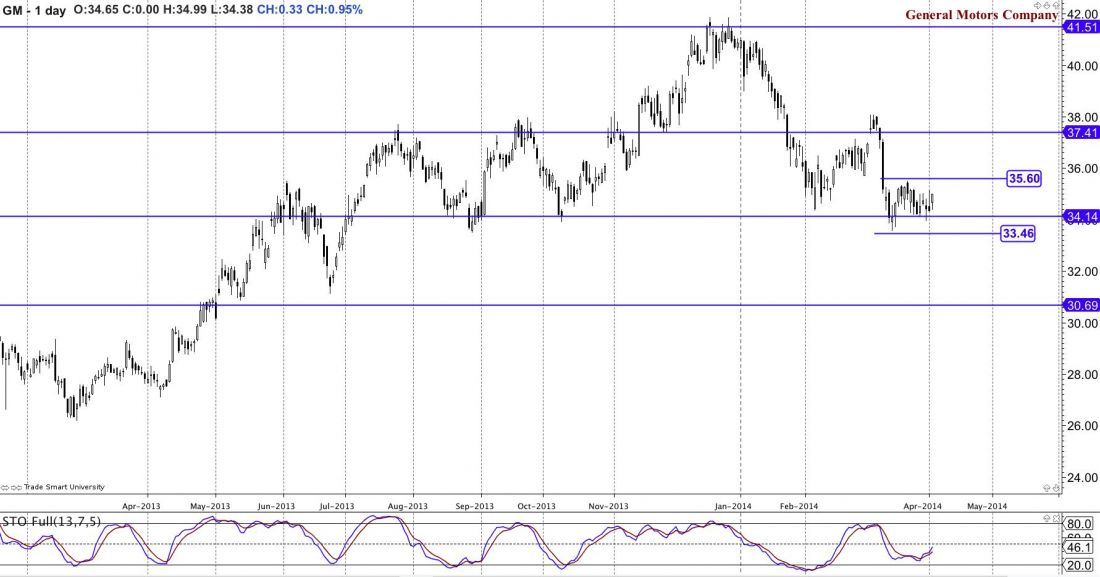

Let’s focus on GM here today and if you want me to analyze F in the future, just ask. GM is in the news a lot lately and the news has affected the stock some. It most certainly has sold off from $41 just a few months ago when GM had a nice topping pattern of some kind.

KEY LEVEL

The $34 level is and has been a strong buying location for GM in recent months past. With earnings coming up later in April (April 24 according to earningswhispers.com) it’s really anyone’s guess what the share price will do. Since both GM and F are such liquid companies and stocks, they rarely do too terribly much over earnings. If you made me choose though, I would anticipate some kind of bearish activity after the earnings report.

Technically speaking though, GM is forming a nice double bottom as we speak. The candle on 4/2/14 (as I write this) looks pretty. Yesterday was a black candle and today is a white candle that opens and closes above the prior day’s close. I like candles when they do that. It shows strong bullish price action.

IT’S HITTABLE

My full Stochastics have curved up as well. Stochastics are a great indicator for a sideways-moving stock, which GM definitely is right now. So, the indicator crossing up would show more bullish momentum than bearish. $37.41 would be target one for sure. If GM begins to pause there a covered call could be sold, and if it’s over earnings, one could reap some semi-decent premium for that call sale. If you’re in shares, I would definitely buy some puts as insurance, just in case. $41.51 would be an ultimate target and with this size double bottom it is, as I say “hittable.”

Some traders suggest this could be a huge and complex Head and Shoulders pattern; I say “maybe.” We obviously would have to wait a few weeks — months to really know. Therefore, I do have a bearish entry. If GM closes below $33.46 I would be more bearish than bullish. I could see the argument for a complex Head and Shoulders pattern; I just won’t put any personal weight, or trades, on that particular view point.

BOTTOM LINE

Create a plan for whatever you decide to trade folks! Proud of each and every one of you – you’ve been doing great! If you need anything, feel free to reach out and as always, TradeSmart!