Shares of the solar company, Sunedison (SUNE), are up 52% year to date.

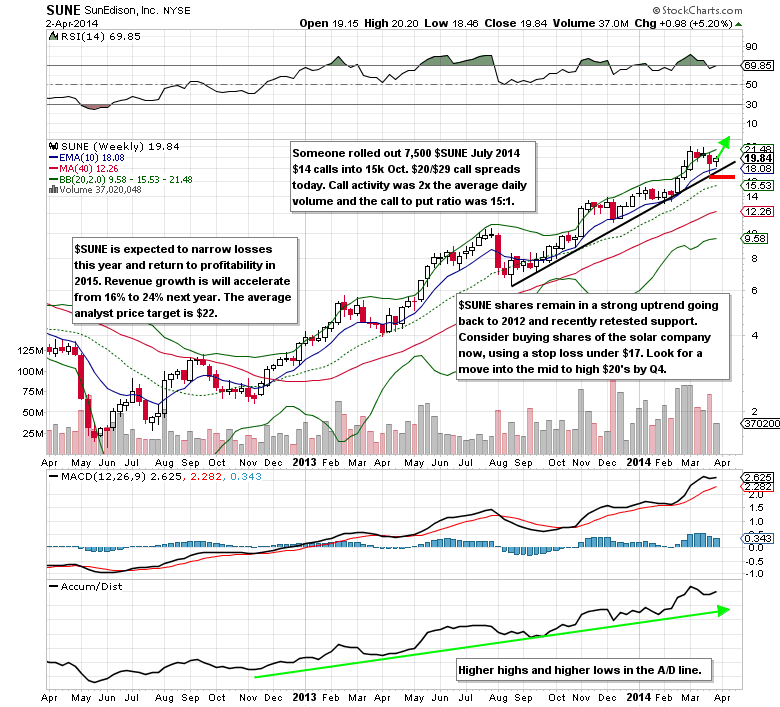

Despite the enormous run up in the stock, there continues to be bullish options activity in Sunedison. On March 28, there was a rollout from 43,611 Apr. $20 calls (credit) into 40K May $20 calls (debit). Even more recently on April 2nd, someone rolled out 7,500 July $14 calls (credit) into 15,000 Oct. $20/$29 call spreads (debit). He/she initially bought the July $14 calls for $2.63 each (135% gain) and now sees up to 45% returns in the stock by October options expiration. Call open interest is currently 405,295 vs. put open interest of 111,521. Sunedison is expected to narrow losses this year and return to profitability in 2015. Revenue growth is will accelerate from 16% to 24% next year. The average analyst price target is $22.

Technical Analysis

The stock remains in a strong uptrend that dates back to 2012 and last week there was a successful retest of support just above $17. A stop loss on a long position can be placed just below $17. The reward/risk ratio at current levels is greater than 3:1.

Sunedison Options Trade Idea

Buy the Oct $20/$29 call spread for a $2.50 debit or better

(Buy the Oct $20 call and sell the Oct. $29 call, all in one trade)

Stop loss- None

1st upside target- $5.00

2nd upside target- $8.00

Disclosure: I’m long the May $19 calls for $2.19 and the Oct $20/$29 call spreads for $2.39.

= = =

Mitchell’s Free Trade of the Day featuring Shutterfly (SFLY)