The bull market that started in March 2009 has yielded several big winners. Be careful, though, because many growth names are forming late-stage bases after massive price gains. Names like Mastercard (MA) and Ulta Beauty (ULTA) come to mind

Why are late-stage bases riskier than early-stage bases? After a stock breaks out from a series of bases, or consolidation areas, its growth story is already known. In many cases, it’s too late to buy. Late-stage bases should generally be avoided because in most cases, the big money has already been made.

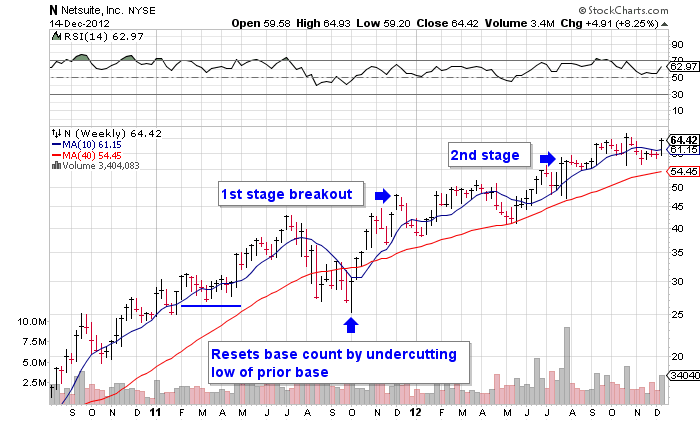

Some growth names currently might look like late-stage bases but they’re not because they reset their base counts. What does a base reset look like? It’s not hard to recognize. It happens when sellers come into a stock spades. The stock pulls back sharply, and the ultimate low of the pullback undercuts the low of a prior base. The thinking is that when enough sellers get shaken out of a stock, it paves the way for a new uptrend.

Since the start of the bull market, shares of Netsuite (N) have gained nearly 500%, but it reset its base count in October 2011. Shares hit an intraday low of $25.32, undercutting the low of a prior base that formed earlier in the year. The new base that formed yielded a fresh, first-stage breakout in December. A second-stage breakout followed earlier this year in July. The stock is currently working on the right side of a third-stage base. Headed into today, it had climbed to within 4% of a 52-week high. Last week was bullish accumulation week for the stock. Shares popped 8.2% on volume of 3.4 million shares. In a normal week,

Netsuite trades about 2.3 million shares.

Netsuite is a provider of on-demand customer relationship management (CRM) and enterprise resource planning (ERP) software. It shows consistent bottom-line and top-line growth in recent quarters and strong growth is expected to continue as demand remains strong for the company’s products and services. Full-year profit is seen rising 60% this year to $0.24 a share and 33% in 2013 to $0.32 a share.

= = =