There is no use getting angry, the stock market is going to do what it is going to do.

There are more reasons to be bearish on this market than bullish, when looking at a technical and in some cases fundamentals. But you can have all the reasons in the world as to why the U.S. stock market should go one way or another. But when it doesn’t do what you thought it should, you have to scrap that plan and move to another.

We had everything in place for a sharp drop-Time-Sentiment-Technical’s and we got the sharp drop right on our turn date, which was February 28.

But it was short-lived and before anyone could even put a short trade on, we were back to new highs. The simple thing to do is scrap that road map and start a new one.

Determine what is the next pivot area-when is the next expected turn period and start trading the new plan.

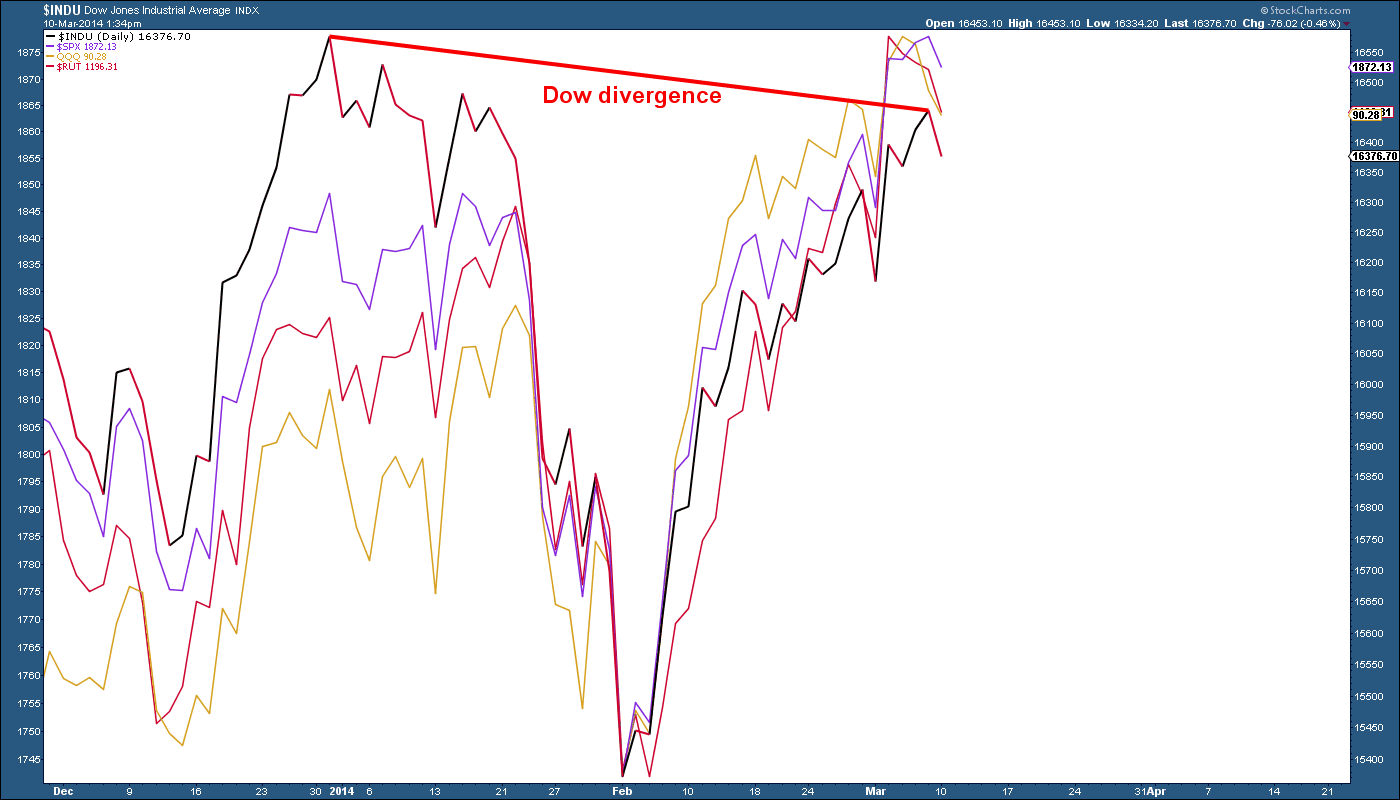

Sentiment remains very high (bearish) but the SPX (S&P 500) refuses to stay down for more than an hour. What is that telling you? The psychology has NOT changed and traders are still willing to buy the dips. There are patterns you want to follow and not all indexes are lined up for the bulls. There is STILL the bearish divergence between the Dow Jones Industrial Average, which has yet to make a new high, as the SPX-Rut (Russell 2000) and NASDAQ have already ticked to new all-time highs.

Unless that fixes itself, it is a warning sign. But until the tape turns lower and stays lower, the bulls are in control. That could change in a minute, but until it does, trade your plan.

= = =

Click here to receive Dean’s free report on the Russell 2000.