I’m not sure how many people were paying attention Friday when major averages flashed a buy signal, but solid percentage gains by the indices on a shortened day of trading means the market tide is once again flowing positive.

Put another way, it means Mr. Market gave the go ahead to start putting some money to work. In the early stages of a new uptrend, it’s important to focus on stocks that have the best chance of outperforming — stocks with bullish fundamentals and technicals. By bullish technicals, I mean stocks that held up relatively well during the recent market decline. They’re not exactly a dime a dozen at the moment, but some growth names are making a case they want to head higher and potentially turn into new market leaders.

TOP PICK

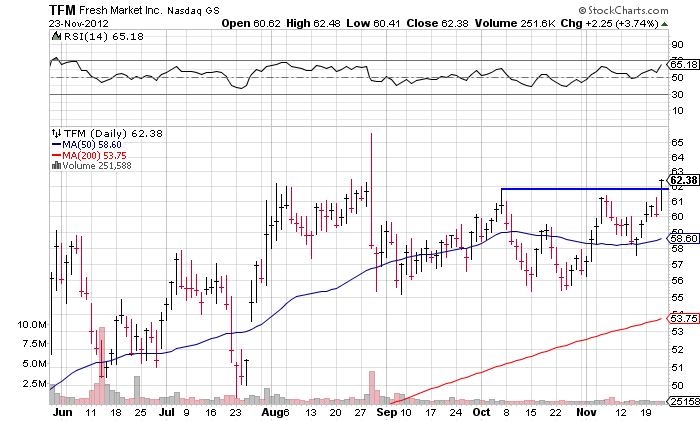

One such name is The Fresh Market (TFM) which reports earnings Wednesday before the open. I like it more than Whole Foods Market (WFM), mainly because I think the big money has already been made in Whole Foods after an 800% move since December 2008. The Fresh Market, on the other hand, went public in November 2010 at $22. It’s still in the early stages of expansion — with California still an untapped market — and could be on the verge of a meaningful breakout from a second-stage base.

The specialty grocer is expected to earn $0.26 a share, up 37% from a year ago. Sales are seen rising 21% to nearly $319 million.

The stock had a wild day of trading the last time it reported earnings in late August, hitting an intraday high of $65.69 and a low of $58 before closing at $58.16. Earnings growth, sales growth and same-store sales growth was strong once again, but investors were spooked by a big rise in expenses. As a percentage of revenue, expenses surged 100 basis points to 23.7% due to higher corporate costs.

Still, with market sentiment improving all around, I wouldn’t be surprised to see the market react differently to TFM’s earnings this time around. Its chart looks solid and yielded a technical breakout Friday ahead of the results. Volume was solid for a half-day of trading at just over 250,000 shares. That’s what it normally trades on a full day.

= = =