When I select a stock for inclusion in my Ultimate Growth Stocks model portfolio, its fundamental and technical picture must be compelling. Sourcefire (FIRE) isn’t in the portfolio yet, but earnings prospects look solid and it’s in a decent technical setup.

EARNINGS OUTLOOK STRONG

Sourcefire sells at a lofty valuation but demand remains strong for the company’s advanced intrusion prevention systems. This year, annual earnings are expected to rise 33% from 2011 to $0.76 a share. Next year, annual profit is seen rising 28% to $0.97 a share.

CHART ANALYSIS

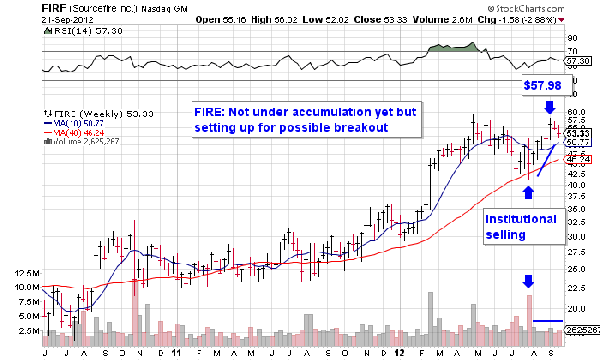

But its chart isn’t perfect. For starters, it’s not clear that funds have been buying Sourcefire lately. The stock has moved up nicely off its lows after a significant bout of institutional selling on Aug. 1, but most of its gains since then have come in light volume. It’s usually good to see some above-average volume price gains as a stock climbs toward its prior high. That’s a sign of at least some institutional buying.

PATTERN IN THE WORKS

Still, it’s not out of the question that funds could start buying Sourcefire soon because it’s on the verge of completing a bullish cup-with-handle pattern. It’s currently forming a handle area, drifting lower in light volume since Sept. 7. The handle area is where the last remaining sellers get shaken out of a stock in preparation for an upside move. Current resistance is at $57.98, its intraday high set on Sept. 6. I’ll continue to watch it for a heavy-volume move over resistance.

M&A WATCH

Sourcefire also has something else going for it. The field of network security is a fragmented one, and fragmented industries are a good source of merger and acquisition (M&A) activity. With a market capitalization of $1.6 billion and strong growth prospects, Sourcefire could easily be a takeover target down the line.

Looking for more trading ideas? Read out daily Markets section here.