It’s that time of year when prognostications abound about what’s in store for 2013.

Stick with the home builders! Embrace the financials! One word: Ugh.

Editors and producers love predictions because it helps clicks and ratings. It makes for great headline fodder, but for individual investors, it’s not very useful information at all. Every year at this time, I’m asked for my predictions for the coming year. I play along, begrudgingly, although every year I find myself saying under my breath: “How the heck I am I supposed to know?”

DON’T LISTEN TO THE HEADLINES

Don’t let the headlines tell you what to buy in 2013. Many investors do, and they end being in the wrong stocks. Instead, let the market tell you what to buy. Institutional buying will uncover the new leadership in 2013. Right now, there’s still a lot of money on the sidelines so it’s impossible to tell where the new leadership will come from at this point.

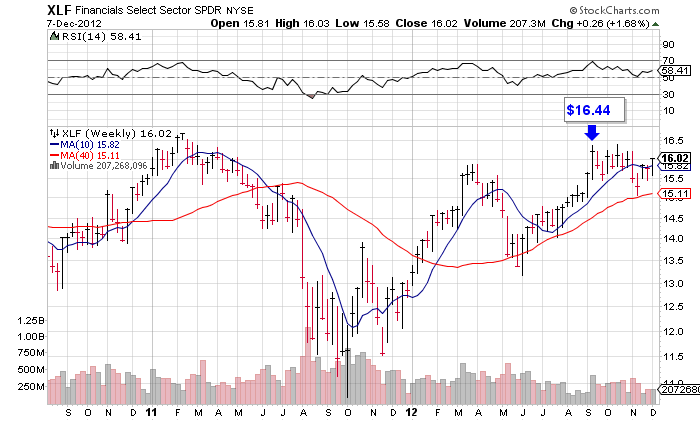

It could very well come for the financials. The Financial Select Sector SPDR Fund (XLF) is setting up in a nice base, but it’s not under accumulation yet. Perhaps it will be soon. Don’t buy in anticipation of it happening. Wait for it to happen first.

STOCK TO WATCH

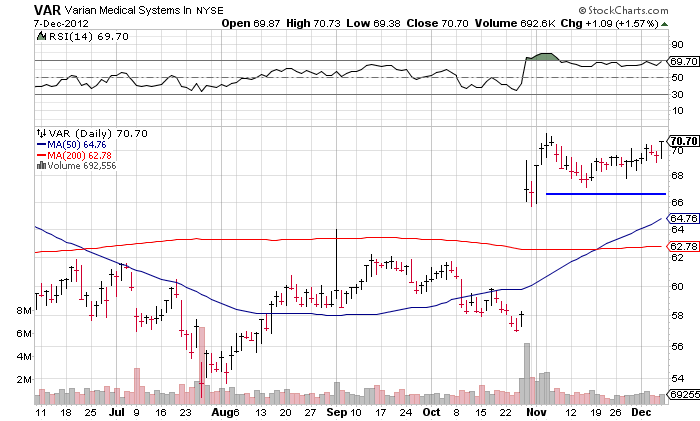

Meanwhile, health care stocks are always a good source of leadership, but it’s a big sector so it’s important to be in the right sub-groups. I’ve got a ton of names in the sector on my watch list, including medical-device maker Varian Medical Systems (VAR). Strong fundamentals and technicals tell me it has the potential to be a leader in 2013. The company’s systems and software are used for treating cancer. It’s in a bullish technical set up that could yield an upside breakout soon. It has a consistent track record of growth and shares remain under accumulation. It’s been holding gains smartly after its earnings-inspired gap up on October 27. Price action like this can often presage additional price strength.

[What’s on your Watch List? Let us know what you are watching, share a comment below.]