US Stocks hit 13 Year Highs – Record Arabica Production from Brazil

In the spring of this year, we outlined a case for selling call options in the coffee market based on the arrival of the Brazilian harvest.

While the calls we suggested remained well out of the money, coffee prices experienced a counter-seasonal rally in June and July (this is, of course, the perfect case for selling options in that you don’t have to get market direction exactly right to profit from short options.)

Financial and commodity news outlets attributed the price rally to “dryness” in Vietnam. But Vietnam exported over 45% more coffee in June than they did in June 2015. Any dryness would likely only have an impact on next year’s crop.

Brazil lost up to 3 million bags of yield to their Robusta crop this year due to isolated dryness in Robusta growing regions. But that news was known as early as April. And 3 million bags was a literal “drop in the bucket” in overall Brazilian output.

No there was something else at work here. At that something else seems to have originated with the Brazilian coffee growers themselves.

While prices tend to fall as the Brazilian crop arrives (Brazil is the world’s largest producer of coffee) It seems that Brazilian coffee farmers had a different approach up their sleeves this year.

As concern over Brazilian government stability faded, the value of the Brazilian Real’ began to surge – just at the time Brazilian farmers are typically unloading their new crop onto the world markets. With the value of their own currency rising farmers yield less of a profit by selling on the global market. Thus, many saw a potential advantage in holding their crop off of global markets in expectation that the real would eventually level off or recede – thus bringing in more dollars for their crop down the road.

—————————————————————————————————————————–

An additional plus of such a position? It can add high octane yields to your portfolio regardless of what goes on in the streets of Mosul or Paris, (or Baton Rouge for that matter) or the election booth this fall.

————————————————————————————————————————-

This appears to have put a temporary crimp into global exports, thus driving coffee prices nearly 30 cents per pound higher from early June through mid-July.

But with the Real’ appearing to approach equilibrium as of late, farmers reluctance to sell is likely to give way in the coming months – especially as the “frost premium” now built into prices (it’s winter in Brazil now) begins to fade in September.

As an option seller, taking premiums at points such as this can be especially lucrative – even if you’re a few weeks early or late to the party. Fundamentally overpriced markets can open up far distant strikes at inflated premiums. As we will outline briefly below, in August of 2016, coffee appears to be such a market.

Ample Supplies of Coffee

Despite the early summer rally in coffee prices, overall fundamentals remain bearish. While the 2016 Brazilian coffee harvest will be just shy of a new record, the expected final harvest of 56 million bags is a monster. But that’s not the real story for prices. Brazilian coffee production is made up of both Arabica and Robusta coffee. Brazil’s Arabica production will swell to an all-time record of 43.9 million bags this year. This is important because higher quality Arabica beans are what makes up the majority of the ICE futures contract (This is what you sell options on.)

In addition to record Brazilian Arabica production, current coffee supplies in the US hit a new 13 year high last month. US green coffee stocks reached 6.21 million bags in June – the highest level since 2003.

————————————————————————

US Coffee Stocks hit a 13 year high last month

————————————————————————

This continues to suggest that the coffee supply picture is far from dire. It fact, it remains outright burdensome – at least for the New York traded Arabica variety.

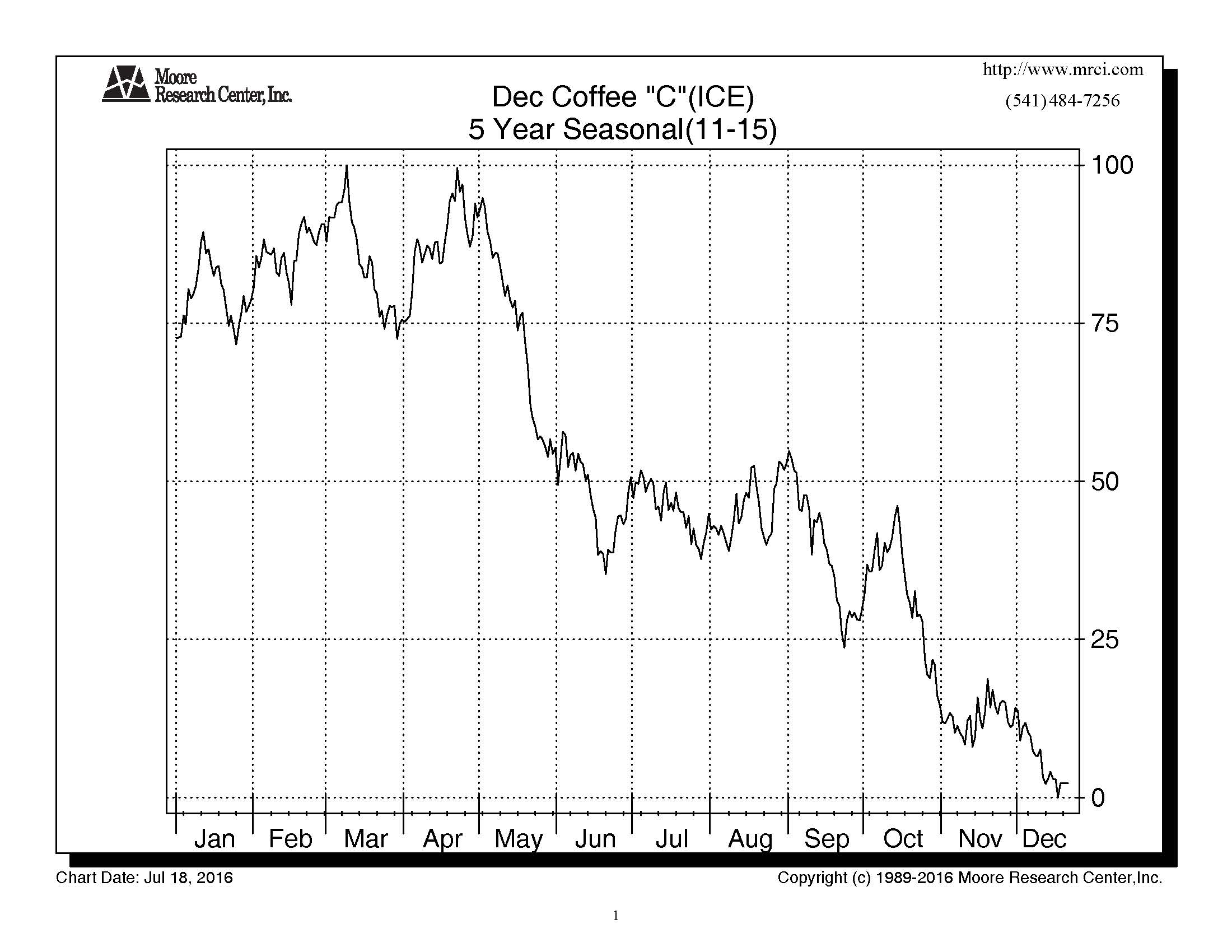

Seasonal Patterns Continue to Loom

While coffee prices defied seasonal norms in June and July, the seasonal factors that tend to pressure coffee prices do not alleviate as the year presses on. In fact, with pent up supply now more likely to be released over a shorter period of time and freeze fears dissipating as Spring approaches, seasonal pressures could become pronounced in the second half of the year as prices “catch up.”

While coffee prices have not yet adhered to seasonal tendencies, price pressure has historically continued in the second half of the year.

Conclusion and Strategy

While Brazilian coffee producers have held onto their coffee with an appreciating Brazilian Real’, one has to wonder if that ship has now sailed. With coffee prices up nearly 25% since June 1, and a decidedly bearish supply picture, it is rational to assume that many will be ready to count their blessings and unload their product at today’s higher prices. This occurrence, should it take place, would almost certainly be bearish for prices.

The latest COT report show speculators heavily long this market (with the net spec long position nearly hitting 50,000 contracts) and the commercial players getting short. Thus, an indication that prices are turning could lead to a “rush for the doors” especially if Brazilian growers are headed to those same doors. A downturn in the Real’ could accelerate such an outcome.

We do not predict a collapse in coffee prices – only pointing out that the environment for such is right. Rather, with bearish supply fundamentals, a heavy spec long position, a market that has already seen a substantial rally and producers that are likely getting anxious to resume forward sales, we – at the very least – see further price gains being hindered.

Fortunately, the recent price strength has nicely inflated deep out of the money calls in this market. For managed accounts, we’re currently pricing calls that are to 80% out of the money for premiums over $600 each.

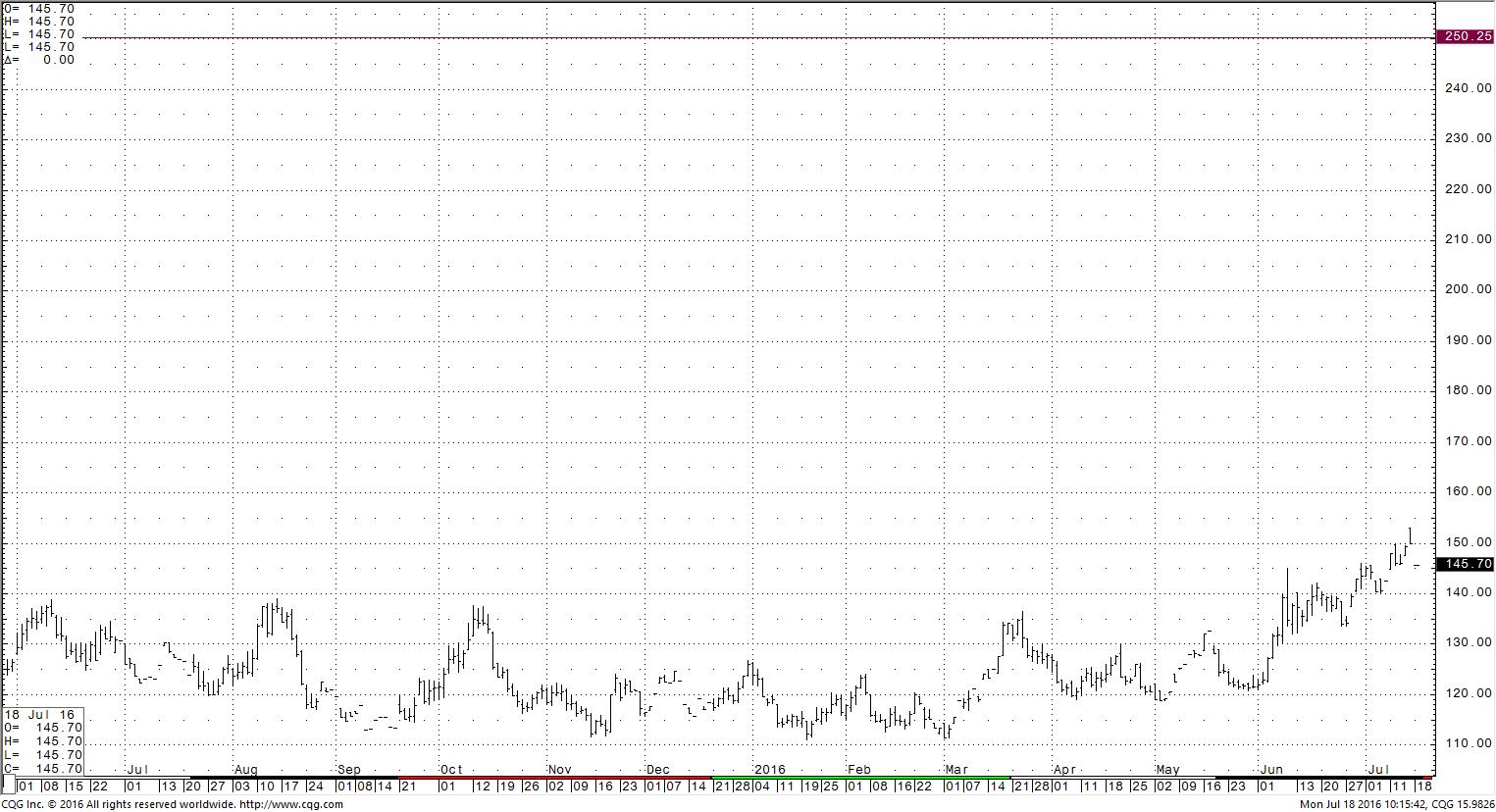

March 2017 Coffee

March 2017 Coffee showing the suggested call strike level. While March is a long way off, lack of a substantial price rally could render these options nearly worthless by November/December.

Positioning in deep out of the money strikes such as these allows the market to continue higher in the near term (should it chose) but also puts you in position to profit from an eventual stall or reversal.

Nonetheless, as high-probability as these trades appear, I would not recommend you take a position in coffee, or any market, in only one strike.

If option selling is a core holding of your overall portfolio and you’re working with an account of $1 Million or up, I recommend building a multi-layer position. By that, I mean it’s made up of various expiration months and strikes and established over a period of weeks or months. Positions like this not only help insulate you against adverse moves, they help smooth out your equity curve over the course of a year. It short, positioning this way, in my experience will help mitigate your risk and maximize revenue in your account.

An additional plus of such a position? It can add high octane yields to your portfolio regardless of what goes on in the streets of Mosul, the closed door meeting rooms at Jackson Hole, or the election booth this fall.

People still drink coffee. And it will still be brought to market and sold. Building a portfolio around such normalcies is how you can still excel in an increasingly abnormal world.

James Cordier is founder of OptionSellers.com, a wealth management firm specializing exclusively in selling options. James latest book, The Complete Guide to Option Selling (3rd Edition) is currently available at fine bookstore, online retailers or at www.OptionSellers.com/Book. For more information on James Cordier’s private client group and investment strategy, visit www.OptionSellers.com/Discovery.