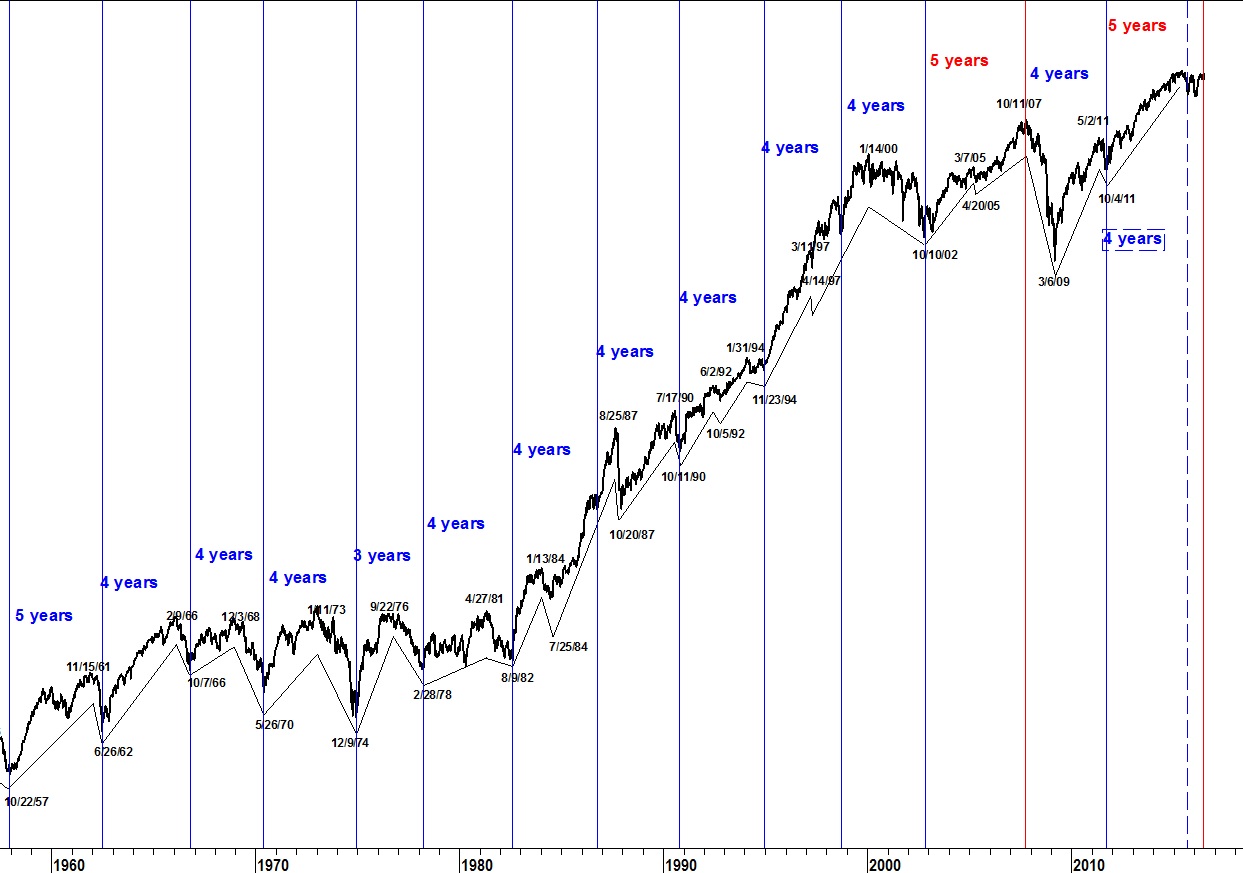

My own observations of a 4 year cycle show a very consistent low in the Dow every four years. In 1962 the cycle expanded to five years and in 1978 it contracted to three years.

The bull market from 2002 never provided a low that could be considered a cycle low and an important high was seen five years later in 2007. That was followed by a significant low four years later in 2011.

That has left the next cycle inflection point in question; a high or low? Four or five years? The Dow did print a low in September 2015 and, while not as significant as most lows, it could be considered a 4 year low.

However, equities have now reached the time period where we would expect a high if a five year cycle high is the correct answer to our questions. We won’t know for a few months but it is certainly worth remembering that the possibility exists.

Take a “sneak-peek” at Seattle Technical Advisors by clicking here.