The risk of war with Syria seems to have passed, for the moment. Now the next big thing is the ‘taper’ – the Federal Reserve’s plan to reduce its “Quantitative Easing.” And the action is going to start Tuesday and continue Wednesday.

A LITTLE BACKGROUND

The Federal Reserve has been spending $85 billion per month to buy bonds and mortgage-backed securities. The effect has been to keep bond prices high and interest rates low. And some fairly large part of that money has leaked into the equity markets where it fueled a remarkable bull run – from 666 to 1700+ in the S&P 500.

Nothing lasts forever, and this bull is getting old. Now the Fed is talking about ‘tapering’ off its bond purchases, and the announcement is expected at the Federal Open Market Committee meeting Tuesday and Wednesday.

Even the rumor of a ‘taper’ has been enough to send the markets crashing down, and the contrary rumor last week – less taper, not more – has set the market on an upside breakout that almost made new highs. Almost.

That’s just the rumor. The real thing will have an even bigger impact.

HOW TO TRADE IT

Tuesday and Wednesday will be no time for the faint of heart to stick a toe in the water. The markets will be choppy.

But in all that chop, we are leaning to the downside. Here’s why.

- Some kind of taper, to some kind of degree, is pretty much already priced into the markets, and especially the index futures, which we trade.

The price action last week looks to us like a relief rally based on hope the news will be less scary than the rumor. So good news is less likely to goose the price – it is already expected. But bad news will kick the supports out, and the decline could turn into a rout.

Stated simply, we think there is a larger potential movement on the downside.

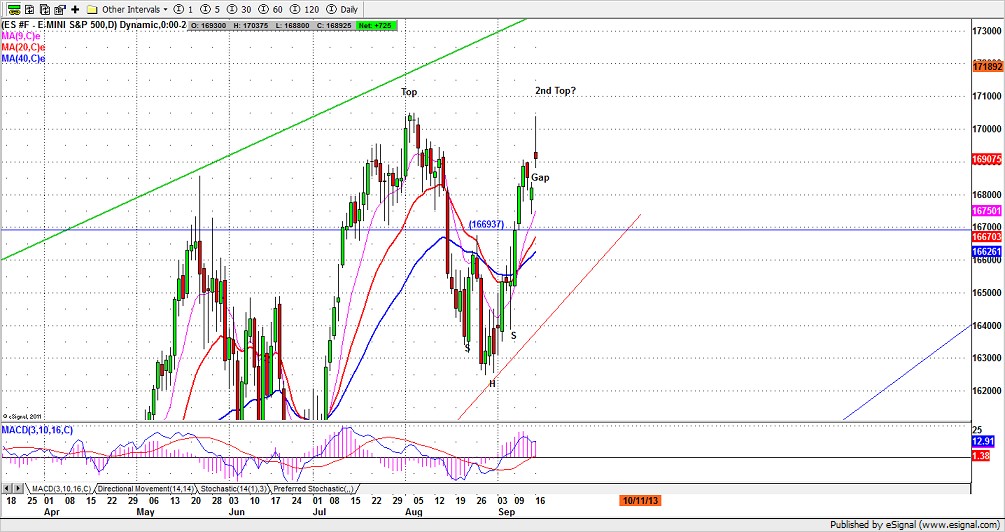

- Technically the market, as identified by the S&P 500 mini futures, looks weak.

- Monday was a classic “gap and trap” day, with a big gap up before the open that traded steadily down throughout the day. The S&P couldn’t make a new high, and couldn’t hold the spike top. The rally looks like it is running out of gas.

- There is uncertainty about the Fed’s future direction and some mechanical disruption in the markets. Larry Summers, the favorite to be appointed Fed Chairman, withdrew from the race, leaving the succession in doubt. And the options market has been in turmoil, with ‘technical’ breakdowns that halted the world’s most liquid market last week and again yesterday. Uncertainty and bad news don’t make markets rally.

WHAT TO LOOK FOR TUESDAY AND WEDNESDAY

In the S&P mini futures (ESZ3) the key support is 1690-88.

- If that support fails the first target on the downside is 1683-82, the gap from yesterday.

- If that support holds, we may see a pop to the 1700 level or slightly higher, to form a double top. That could be a short entry.

- And watch for an increase in volume, especially on the downside. That could be the first sign to dam is cracking.

For the record, we are still bullish for the longer term. We are looking for a short-term trading profit, not a long-term position. There are lots of signs of a short-term reversal, but nothing is guaranteed, and it may not materialize.

But if it does, stand ready to profit from it.

Chart: ESZ3 Daily Chart

= = =

Polly Dampier is the brains behind Naturus.com, a subscription service that provides real-time market direction for active traders. For more information, contact admin@naturus.com or visit www.naturus.com.