The market is facing a pretty significant lower opening today prior to the all important jobless claims and durable goods orders reports. Investors are not expecting bright numbers in the durable goods and unemployment sector, and there is very little news out there to give much boost to the market. Our two open positions that we were looking to close today might have to wait. Lennar (LEN) reported fantastic earnings, hitting an EPS of 0.21 vs. the expected 0.00. Yet, the stock is not getting any boost due to the fact that the company saw orders decline 10% after the tax credit expired. The stock is down just slightly in pre-market. I think we should wait and see what happens with Lennar. Discover released some  great earnings, as well. The company made a 200% surprise profit beat per share, hitting 0.33 vs. the expected 0.11. The company had record cards sales volume for a Q2 ever, saw its write-offs and delinquencies down, and had a significant income improvement. The stock is moving upwards over 4% in pre-market on top of gains we made yesterday. I am looking to sell out of the open.

great earnings, as well. The company made a 200% surprise profit beat per share, hitting 0.33 vs. the expected 0.11. The company had record cards sales volume for a Q2 ever, saw its write-offs and delinquencies down, and had a significant income improvement. The stock is moving upwards over 4% in pre-market on top of gains we made yesterday. I am looking to sell out of the open.

Let’s get into some picks for today…

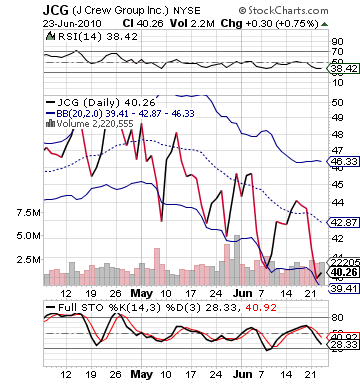

Buy Pick of the Day: J. Crew Group Inc. (JCG)

Analysis: A lower than expected job loss report and better than expected losses on durable goods orders has given a rise in the loss to futures we were seeing this morning, moving from down to over 70 points to in the low 40s now. That upward trend is giving me hope for today’s market. Another great sign is that I am seeing an almost 5:1 ratio on upgrades to downgrades this morning. The release of the data gave a great spike to the European markets that is holding. Also, great earnings from Discover, Lennar, and McCormick are good signs as well.

One such company that is in a very weird position this morning is J. Crew (JCG). The specialty retailer known for their preppy lines has been one of the best successes over the past few years, but it has been hit as of late. The stock has fallen 15% over the past month and a half, and the company is actually down more in pre-market trading, nearly 3%. Yet, there is really no news out there to spark such selling. The company is simply in a downward trend that should start to see a…

news out there to spark such selling. The company is simply in a downward trend that should start to see a…