Good morning to all. A lot of disappointing news out this morning, but we are lucky to be well positioned in a good one. We got involved in an Overnight Trade with Whirlpool yesterday. I got in at 88.50. The company this morning reported a solid EPS at 2.64 vs. the expected 2.13 and increasing heavily over last year’s EPS of 1.04. Revenue increased more than 8% year-over-year as well. Whirlpool even raised their full year outlook, but with the rest of the market being as it is, WHR is sitting pretty much neutral but closed up a little over 3% from my entry. I will be exiting within the first five minutes of today’s session.

Good morning to all. A lot of disappointing news out this morning, but we are lucky to be well positioned in a good one. We got involved in an Overnight Trade with Whirlpool yesterday. I got in at 88.50. The company this morning reported a solid EPS at 2.64 vs. the expected 2.13 and increasing heavily over last year’s EPS of 1.04. Revenue increased more than 8% year-over-year as well. Whirlpool even raised their full year outlook, but with the rest of the market being as it is, WHR is sitting pretty much neutral but closed up a little over 3% from my entry. I will be exiting within the first five minutes of today’s session.

Let’s get into two plays for today…

Buy Pick of the Day: Seagate Technology Inc. (STX)

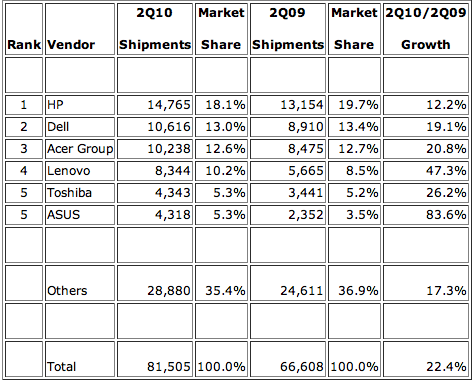

Analysis: The report on the right side is from Interactive Data Corp. The company does surveys, graphs, charts, forecasts, etc. of everything technology. In Q2 of 2010, the company reports that PC sales rose 22% year-over-year. That is a significant growth in sales for a slow month to buy laptops and PCs from April to June. This growth, among other computers and server-type products, has led to some outstanding earnings from PC supplying companies, such as semiconductors, analog devices, and data storage. One such company, which is reporting earnings this afternoon, is Seagate Technology Inc. (STX).

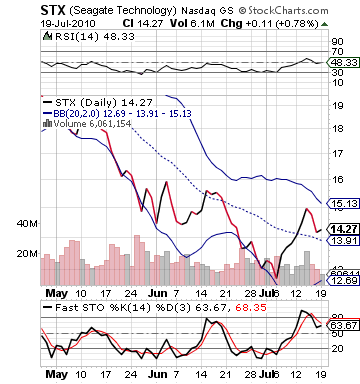

Seagate is a data storage company that manufactures and sells hard disk drives. Seagate supplies HP, Dell, Apple, Acer, and many more. The company is one of the top dogs in data storage devices, and they should benefit from a great tech season so far. The company is expected to report earnings at 0.77, which will be a great increase over the EPS one year ago at 0.05.  The company is also been rising into earnings, but they have slipped this morning with the market’s woes.

The company is also been rising into earnings, but they have slipped this morning with the market’s woes.

That is why STX holds such an opportunity. It is a company that should follow in line with the other tech companies that have been doing exceptional, and investors should be buying it up into earnings. Yet, it has fallen on its face a bit this morning as a result of a few giants’ struggles. So, we want to take full advantage of this opportunity and buy some of it up. I am expecting a nice big gain from this company today as it moves into earnings. Other DSD companies have…