Hope everyone is having a great week thus far. We are looking pretty healthy in our current positions. We sold half of our Play of the Week position in Ista Pharmaceuticals (ISTA) at 4.43 to close the day for a 4% gain. We still are hanging onto half towards the end of the week to see what else we can get out of this one. Additionally, we got into a new position yesterday in Winnebago Industries (WGO) at 10.50. We are looking to gain 3-5% today off this one, and I think it can definitely be reached. The market is looking very strong to start the day after the first major bundle of important earnings came out last night and this morning.

Hope everyone is having a great week thus far. We are looking pretty healthy in our current positions. We sold half of our Play of the Week position in Ista Pharmaceuticals (ISTA) at 4.43 to close the day for a 4% gain. We still are hanging onto half towards the end of the week to see what else we can get out of this one. Additionally, we got into a new position yesterday in Winnebago Industries (WGO) at 10.50. We are looking to gain 3-5% today off this one, and I think it can definitely be reached. The market is looking very strong to start the day after the first major bundle of important earnings came out last night and this morning.

Additionally, yesterday we introduced the new 45 Going For $5 List, and we posted a link to view our Longterm Ratings in a quickview spreadsheet.

Let’s look at another new play for today…

Buy Pick of the Day: Safeway Inc. (SWY)

Analysis: This one is not super difficult to figure out for us. For one, the market is looking extremely strong to open higher among many sectors after surprisingly good earnings from a number of companies. Only one company out of the thirteen that reported today and last night missed their EPS estimates. Early signs look positive for another round of positive quarterly earnings in QE3. The strong market has drove up futures for most companies and should take them higher throughout the day.

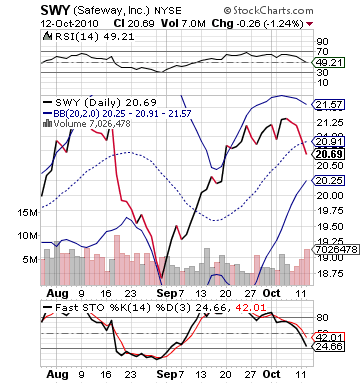

In addition, the market should continue to be boosted by the Fed’s commentary that there will be quantitative easing. One company that should benefit from the market’s movement and has its own abilities is Safeway. The company is a discount grocer that operates throughout the country. They are scheduled to report earnings tomorrow morning with an EPS of 0.31. Of  all the reporting companies tomorrow, they are the only one that has an RSI below 50. They should be able to get some nice movement off of pre-earnings movement throughout today since things are looking positive.

all the reporting companies tomorrow, they are the only one that has an RSI below 50. They should be able to get some nice movement off of pre-earnings movement throughout today since things are looking positive.

The company does not trade in pre-market, so it is tough to tell where it opens. If the company opens 1-2% higher, it will still have 3-4% movement to its upper bollinger band. The company is note expecting year-over-year EPS growth, but that does not mean that investors won’t enter the stock today. The stock is undervalued on RSI, closer to its lower bollinger band,…