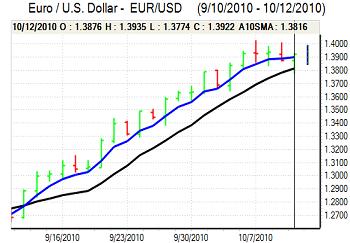

EUR/USD

The Euro maintained a weaker tone during Asian trading on Tuesday with a dip to test support in the 1.3850 area against the dollar as risk appetite remained weaker, although the US currency was still finding it difficult to gain any strong support.

The Euro retreated further to lows below 1.38 against the US currency in European trading as profit taking intensified. There was, however, a recovery later in the session with firm buying support on dips. The Euro was also boosted by comments from Bundesbank head Weber who stated that the bond-buying programme should be ended immediately which increased market expectations that there would be ECB resistance to quantitative easing measures.

The US economic data did not have a major impact with consumer confidence edging higher in September according to the IBD survey as markets looked ahead to the Friday retail sales data.

Minutes from the Federal Reserve September meeting stated that additional policy action may be required if the economic outlook worsened. There were also comments over the need to avoid any deflation pressures and that inflation expectations could be pushed higher to help boost consumer spending. These comments reinforced speculation that the Fed would move towards additional quantitative easing and the Euro recovered back above the 1.3920 level later in the US session as the dollar came under fresh selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk conditions remained more fragile during Tuesday with Asian equity markets registering the largest decline for over six weeks. This decline in equity prices provided underlying support for the yen, especially given doubts over the G7 growth outlook.

There was importer dollar demand below the 82 level and there were still reservations over aggressive dollar selling given the intervention risks. The dollar consolidated just below 82 after failing to break above 82.35 as the central bank again stayed out of the market during the Japanese trading session.

The dollar was subjected to renewed selling pressure during the day with lows below 81.70 early in the US session. After a brief recovery, the dollar retreated again following the FOMC minutes as yield support remained weak.

Sterling

The UK currency held steady on Tuesday despite another weak RICS housing survey with the house-price index dipping to -36% for September from -32% previously. The BCC also warned over a third-quarter slowdown in the economy even though playing down the prospect of a double-dip recession.

The inflation data also did not have a major impact with the headline consumer rate in line with expectations at 3.1% for September with a core reading of 2.7%.

There was a further focus on potential monetary easing during the day. MPC member Miles stated that quantitative easing may have to be used again over the next few months which reinforced speculation that the bank could move to additional policy easing.

The trade deficit narrowed to GBP8.2bn for August from GBP8.7bn the previous month and the underlying export performance will continue to cause underlying concerns with trade not able to provide a positive contribution to the economy.

The speculation over additional monetary easing was a negative Sterling influence and it retreated to lows below 1.5770 against the dollar. There was a partial recovery as the dollar came under pressure, but there was renewed selling pressure against the Euro with a retreat to beyond 0.88.

Swiss franc

The Euro was blocked just above 1.34 against the franc in early Europe on Tuesday and then weakened steadily during the day with lows near 1.3270 before a partial rebound. The dollar was blocked above 0.9720 against the dollar before weakening to lows below 0.96 as the franc gained on the crosses.

There was further speculation that the Federal Reserve would move toward additional quantitative easing and this was again an important factor in providing underlying franc support.

Fears over medium-term moves towards currency depreciation continued to provide important underlying backing for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

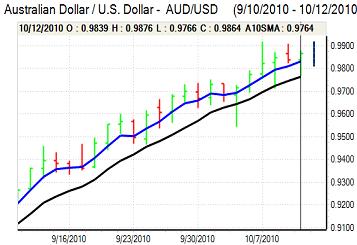

Australian dollar

Risk conditions were more cautious in local trading on Tuesday with a decline in Asian equity markets and the Australian currency tested support below the 0.98 level. There will be further concerns over the competitive situation surrounding Australia and there will also be fears over a slowdown in the domestic economy.

Risk conditions are also likely to be fragile, but there will be confidence that global central bank action will help underpin capital flows into the Australian dollar. In this context, a generally dovish set of Federal Reserve minutes pushed the Australian currency to highs near 0.9870.