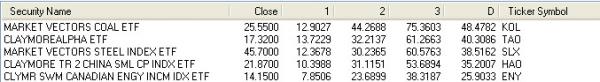

Not much has changed over the past week since last running this particular short-term relative strength ranking screen on a diverse mix of ETF’s covering a range of global stock indexes, commodity-linked stocks and US stock industry groups:

SLX, KOL, TAO and HAO remain at the top of the rankings, while GDX has slipped lower, replaced by ENY, the Claymore/SWM Canadian Energy Income ETF. For as long as these particular ETF’s remain highly ranked, traders and investors can likely assume that small-cap stocks in the Chinese market may be opportune places to deploy capital, just as stocks from the coal, steel and Canadian oil/gas income trusts should also be attractive places to seek short-term trading opportunities – especially on daily pullbacks, such as we are witnessing today.

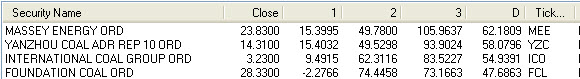

Some traders and investors choose to pursue a ‘relative strength’ method of timing trades, and such a ranking system (like that depicted above) can make profits over the long term, despite the potential for significant drawdowns when the broad markets reverse lower. Those seeking a little more peceived ‘control’ over the timing of such trades may instead seek to focus on the component stocks of such ETF’s, using a daily-based timing method on the strongest stocks from the strongest ETF’s. Here are some of the strongest relative strength stocks from the coal industry group:

Massey Energy (MEE), Yanzhou Coal (YZC), International Coal Group (ICO) and Foundation Coal (FCL) lead the pack in terms of short-term relative strength in the coal industry group. There are a variety of short-term trading methods available to help time entries, but only you can know what kind of system is appropriate for your particular trading needs and goals. I suggest that whatever method you select has a history of profitable long-term performance, something that can only be determined by diligent, exhaustive backtesting and forward testing. Here are a couple of basic short-term trading methods to consider:

1.) Buying/selling pullbacks against a well-established trend.

2.) Buying/ selling trend reversals based on an anticipated major turn in a higher time frame.

See if you can determine what kind of trading style most closely resonates with your personality before you actually start to deploy money into the financial markets, only doing so after properly back and forward testing the sytem of your choice.