That is, of course, what residents of Macau are required to chant every morning in honor of Stanley Ho, who held the monopoly on casinos in China until 1992. This morning it turns out Macau’s economy contracted by 13.7% in Q2, it’s 3rd consecutive quarter of shrinkage. It’s possible that the restrictions placed on civil servants in 2008to stop themfrom gambling and to curb money laundering has caused much of the decline why is the decline accellerating if things are so good in China? One thing about Macau is that all the US businesses that are now there make it harder for the Chinese government to pad the statistics and, taken at face value, Maccau is underperfoming the rest of China by 22%.

This is worth noting today as China is leading the market bounce as the vice chairman of the China Securities Regulatory Commission, said the authorities will promote a “stable and healthy” market, tempering investor concern that the government wants to curb equity and property speculation. Ministers from the Group of 20 nations are likely to suggest the global economy is healing when they meet in London this weekend, while the European Central Bank probably will keep interest rates at a record low today. The Shangai composite index ran right up to the 5% rule today and has pulled a turnaround in global equites. As noted in David Fry’s chart, we were oversoldand due for a littlebounce anyway.

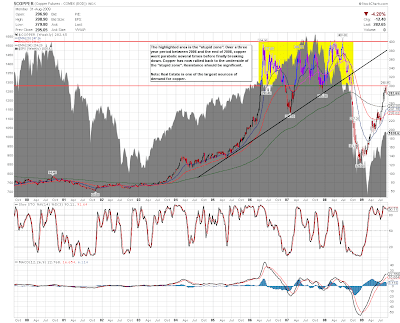

As noted by Ben over in our Chart School section, copper has climbed back into the “stupid zone” on that news.

This is not surprising to us as we read the Fed minutes yesterday and the greenest shoot they could find was that things were picking up in other countries, a favorite ploy we discussed in Monday’s post as the Shanghai was falling 6.7% that day. Fortunately, we were playing bullish into the close as we know how this game works and I had said to members just ahead of the Fed, at 1:58: “Beware bears – I was just noticing that last minutes were May 20th and July 15th – both ahead of major rallies!“

As I had mentioned in yesterday’s morning post, our bearish bets were already on from last week and yesterday was a day for bottom fishing as we pickedbullish (but hedged) plays on TTWO, RT, DIA, DIS, HMY, ABX, STX, BEAT along with a complex spread on UNG…