The Market is Getting Nervous

The number of distribution days (a sign of professional selling) has been increasing since late July. We can expect this means the bears are gaining confidence while bulls get nervous. There are various bull/bear arguments circulating in social media, but the market now at a critical point will let us know soon enough who is on the right side of this argument. Summer is over and soon it will be business as usual as Wall Street returns from summer vacation.

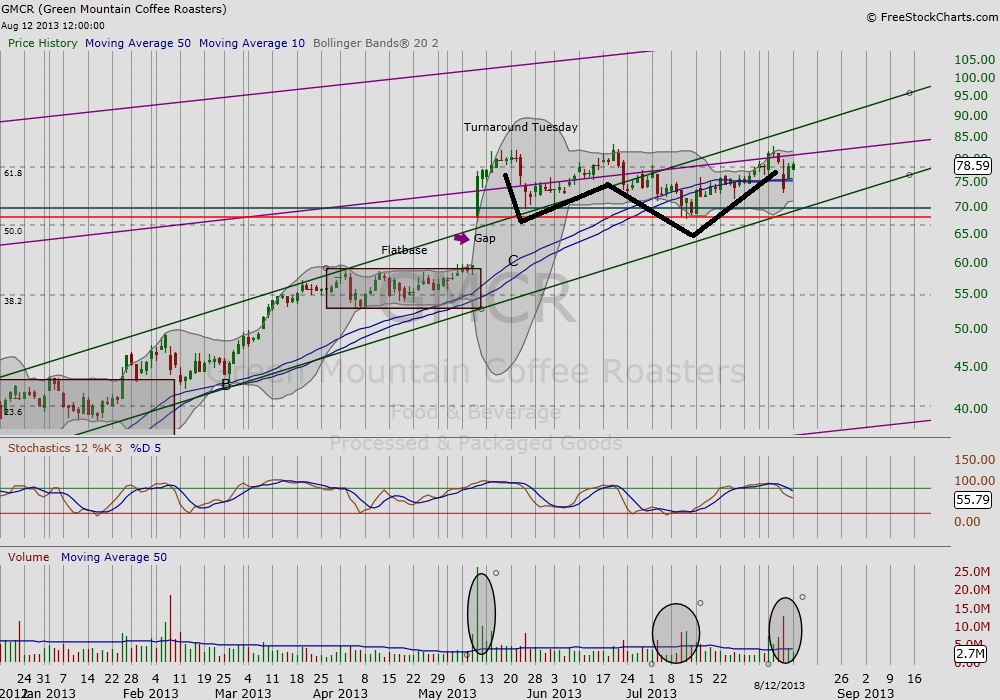

WILL GMCR BREAK OUT?

Green Mountain Coffee Roasters (GMCR) has been a favorite for growth traders since the market bottomed in March 2009. In fact, GMCR did not waste time, bottoming as early as October 2008, and breaking out of months-long base by early March. Retail and GMCR peaked in the fall of 2011, and today the market wonders if GMCR is still a growth stock or will future earnings be lackluster. Unlike Facebook, Inc. (FB) and Tesla Motors, Inc. (TSLA) who have made impressive gains since the market found a base this summer in late June, GMCR continues to trade sideways. Except for business cycle peak years, e.g. 2001, 2008 and 2011, GMCR stock often heads up in the fall. We’ll soon see if this year will be an exception.

NERVOUS PRICE BEHAVIOR

GMCR appears to have formed a “W” base following “Turnaround Tuesday” this May. In late June when the general market seemed to have found a summer floor, GMCR instead continued to sell off until finally finding a floor the week after 4th of July. The same week, the overall market strengthened and GMCR found support at the bottom of its May gap. In the last week and a half, the market has gotten nervous and GMCR’s has followed suit.

POSITIVE

As in early July, the market showed support last week when volume rose as GMCR broke below but then recovered its 10/50 day ma.

TREND LINES ACROSS TIME

Recouping the purple channel (below) and breaking out from its latest base will confirm the market believes GMCR has room to grow. Figure 2 shows GMCR’s trajectory over the last decade. The purple channel that today serves as the current resistance is the channel in which GMCR traded following the market recovery in 2009. A proper breakout of its latest base should be confirmed with above average trading volume to confirm market support.

TAKEAWAY

Summer’s over. It is time for this uptrend to either pick up momentum or break down. A positive sign will be more leaders breaking out from weekly bases. GMCR may be one of these. Watch for positive price action confirmed by volume in the next week or so.