Now that a week has passed since Twitter’s debut on the NYSE floor, we can start looking at how to seriously trade this stock.

The classic way to do it is to go long the stock and wait patiently for TWTR to prove its value. Will investors promote continuous buying of Twitter like they did with Google (GOOG) and Amazon (AMZN) or will there be a lot of zig-zag moves like we’ve seen with Facebook (FB)?

ETF PLAY

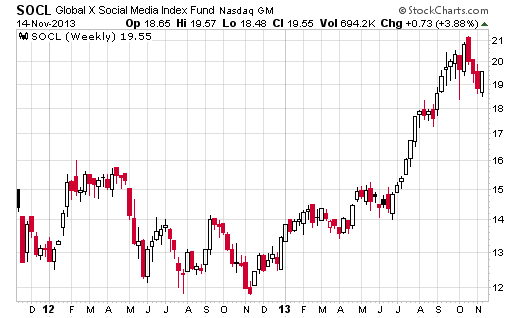

Another more prudent and conservative way to enter this stock and similar ones of the same category is to invest in the Global X Social Media Index ETF (SOCL). This ETF has recently allocated 4.5% of its weight to the newly public social media firm (TWTR) making the stock the ETF’s eleventh-largest holding.

Although we might believe that SOCL is purely social media based, the truth is that many of its components are solid internet companies such as Google and LinkedIn, along with other stocks that are not necessarily exclusively social media such as Zynga (game developer), Pandora Media (internet radio) and Groupon (ecommerce). This ETF also includes international giants such as Yandex NV (Russia) and Tencent Holdings (China).

SOCL has over $100 million in assets under management and is up close to 50% in 2013.

===

Learn more on Amar Daryanani’s five steps to analyze charts

Join the conversation on our Facebook page. We’d love to hear from you.