In this article, I will share the framework of my intra-day trading methodology. I will demonstrate how to place five to fifteen round-trip intra-day trades in the first two hours of the market, for each stock you are watching. My intra-day system is based on taking small 15 cent profits on quick reversals after a support/resistance break and is known as “countertrend-reversal trading,” not to be confused with “scalp” trading.

I will show which stocks trade the best during the first two hours of the market and will demonstrate why trading in 100 share-blocks and using a pay-per-share broker are essential aspects to my approach. You will learn how to trade both “previous” levels and how to recognize “newly forming intra-day” support/resistance levels. Here we are only learning my basic strategy. Please do not try to trade this strategy without being formally trained.

Before this system can be applied you have to acquire the correct stocks. My system requires stocks to be priced between $100-$250. This means the stocks have plenty of volume/liquidity, therefore the stocks offer several intra-day support/resistance levels to trade in the first two hours. Stocks like AMZN, IBM, CRM, and GS are on my personal stock list.

When trading high priced stocks you only need to trade in 100-share blocks for each setup. This is important when trading via a “pay-per-share” broker. You should be paying about .0045 per share; this translates to 45 cents per 100-share trade. With my system you should not be paying more than $1.00 per trade. The only barrier to enter the market (quite literally), is that you will be required to have at least $25,000 in your account to intra-day trade (S.E.C “pattern day trade rule”).

In general, I will go long initially after a support has just broken, and I will short soon after a resistance has just broken. I do not try to predict how far a trend will continue, rather I wait for a trend to exhaust itself, and then I come in for a small profit on the inevitable pullback in price. The main element that allows this system to work consistently is the small profit taken of 15 cents ($15 on a 100-share trade), especially after the price typically runs a full $1-$2 before I enter a trade, therefore, on sheer volatility you gain your 15 cents on the reversal.

I always start by watching the pre-market (8 a.m. to 9:30 a.m.). I gather several previous price levels for my initial S/R. Once the bell rings I am armed with price levels to trade, whether the price travels up or down I have long and short positions to trade in the first two hours.

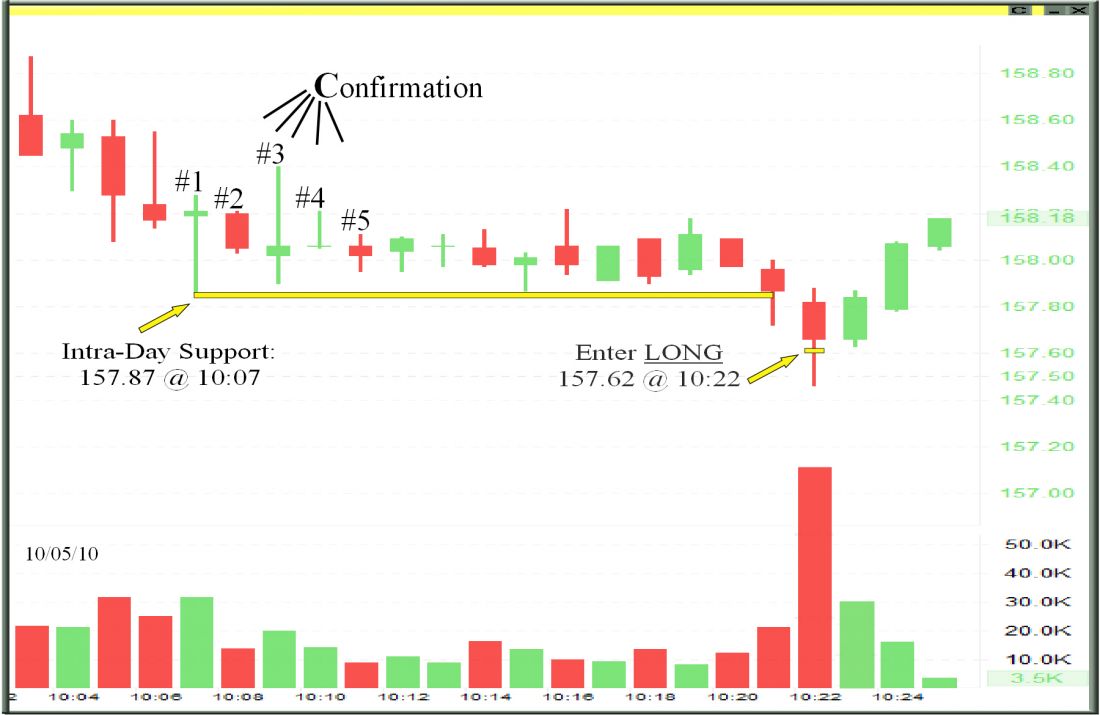

After the first five minutes of trading “newly formed” intra-day levels (S/R) start to form, my system shows you how to find and trade these levels. These levels are found by using what’s called the “five candle-stick rule.” Figure 1 demonstrates how intra-day setups occur.

I use the one-minute candle sticks to find intra-day levels and the daily chart to find previous levels. Previous levels include levels found on the daily chart, previous day high/low, and premarket high/low.

For instance, I use the highest and lowest price for certain levels on the daily candle stick chart, and the previous day high/low, and pre-market high/low price levels for the current intra-day’s support/resistance.

If an intra-day level forms I will enter a trade exactly 25 cents past the price level on the initial S/R level breakout (as shown in Figure 1).

- If an intra-day level forms I will enter a trade exactly 25 cents past the price level on the initial S/R level breakout (as shown in Figure 1).

- If a previous level forms I will enter a trade exactly 50 cents past the price level on the initial S/R level breakout.

In Figure 2,

Here is an example of an actual trading session with Amazon (AMZN) from 9:30 a.m. to 11:30 a.m. (12/17/12).