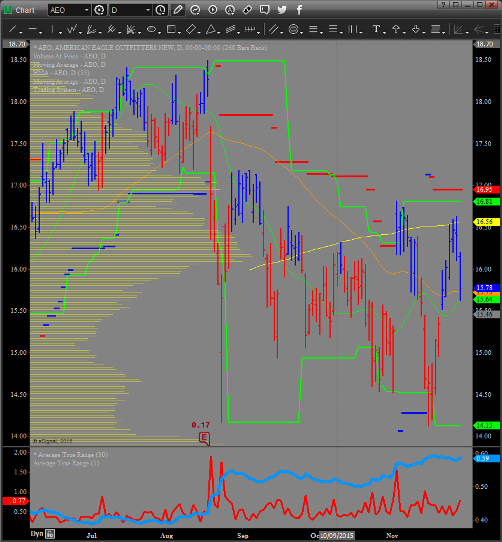

Today we are going to consider an American Eagle Outfitters AEO) earnings play in slow motion. AEO is an apparel and accessories retailer. The Company offers clothing, accessories and personal care products. The Company operates under the American Eagle Outfitters and aerie by American Eagle Outfitters brands. The American Eagle Outfitters brand offers denims, pants, shorts, sweaters, fleece, outerwear, graphic t-shirts, footwear and accessories. Quite frankly, the chart is really nothing to write home about:

Since August/September, it’s a pretty sideways stock. But after having seeing some of its peers get beat up like: GPS, BKE, TLYS and URBN, it would be easy to put the hurt on AEO. So far, they have not. They have actually been ok over the past year on earnings. So, if we can find the proper reward to risk, an upside play might be considered.

I want to give myself a couple of “options” going forward. First we are going to start signaling to simply purchase the December 17 calls for $0.30. If we get this, we immediately have two opportunities depending on the circumstance. We can immediately sell the weekly (12/4 expiration) calls for $0.20 to have the calendar on for $0.10. We can even sell the same weekly expiration 17.5 calls for $0.15 to have the diagonal on for $0.15. Or, we can hold for a run-up before earnings and perhaps even sell out regular December 17.5 calls for $0.25 to leg into the vertical for $0.05. Just have to see how things play out. But, you have a day or two.