As every market pundit tries to guess the direction of the S&P 500, there has been plenty of opportunity that would have served investors better than fretting over short-term volatility and trading the broad market.

Trading the S&P 500 is not a strategy. As the market gave investors a flashing warning sign that risk premiums were changing, many investors continued to defy price and chase high momentum names that do not work. Even as the S&P 500 stabilizes and possibly retests the previous highs, do not expect momentum/high valuation stocks to lead or recover. The rebalance was real and the market has told you that the two-year old trade long high multiple names and short value is over.

CHANGE YOUR STRATEGY

So don’t be trapped into the perils of buying weakness as that is the greatest way to failure. Look for a strategy that is repeatable and sustainable for long term gains that will minimize downsize volatility.

The most basic concepts of both trading and investing is to avoid large drawdown’s at all costs. One time tested strategy is buying an equally weighted portfolio allocated to the strongest stock in each sector (Preferably at least 20 stocks). This does not mean buying the strongest sector in the form of an ETF. Averages are slow to move and you will be late to the trade as most of the upside has been achieved.

SECTOR ANALYSIS

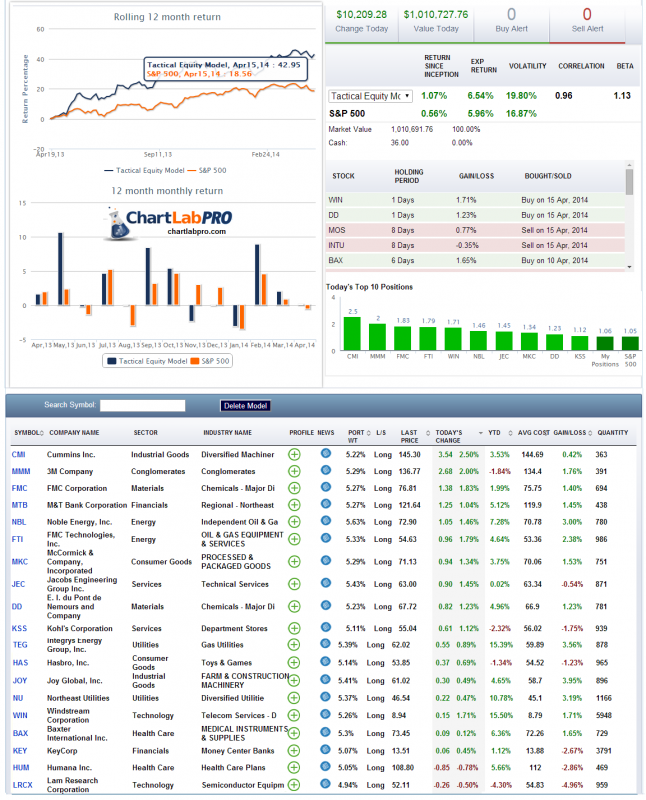

We show ChartLabPro.com’s proprietary Tactical model below. It lists the two strongest stocks in each sector. Over the last 12 months the model is up 42.95% vs. 18.56% and flat for the month of April with a current beta of 1.13. The names in the model are as follows.

BAX – Baxter International Inc. Health Care MEDICAL INSTRUMENTS and SUPPLIES

CMI Cummins Inc. Industrial Goods Diversified Machinery

DD E. I. du Pont de Nemours and Company Materials Chemicals

FMC FMC Corporation Materials Chemicals

FTI FMC Technologies Energy Oil & Gas Equipment & Services

HAS Hasbro Consumer Goods Toys & Games

Humana Inc, Health Care Healthcare Plans

JEC Jacob Engineering Group Services Technical Service

Joy Global Industrial Goods Farm & Construction

Key KeyCorp Financial

KSS Kohl’s Service

MKC McCormick & Company Consumer Goods

MMM 3M Company Conglomerates

MTB M&T Bank – Financials

NBL – Noble Energy – Energy

NU – Northeast Utilities

TEG Integrys Energy – Utilities

WIN Windstream Corporation – Technology

LRCX – Lam Research – Technology

= = =

Learn more at ChartLabPro.com