CBS shares are down 5.23% year to date (11.45% from the March highs), which follows a 64.91% gain in 2013. Earnings grew 22.18% to $3.03 per share last year and are expected to grow 15.23% in 2014. Revenue growth is expected to be minimal over the next two years, but it is expected to increase 1.32% this year. CBS trades at a P/E ratio of 17.33x and a PEG ratio of 1.14x (2014 estimates). The average analyst price target is $63.00. On Wednesday, April 16, CBS announced that the IRS is allowing CBS Outdoor Americas (CBSO) to convert into a real estate investment trust (REIT). CBS own 81% of the outdoor advertising subsidiary. Q1 earnings are due out on Thursday, May 8.

OPTIONS ACTIVITY

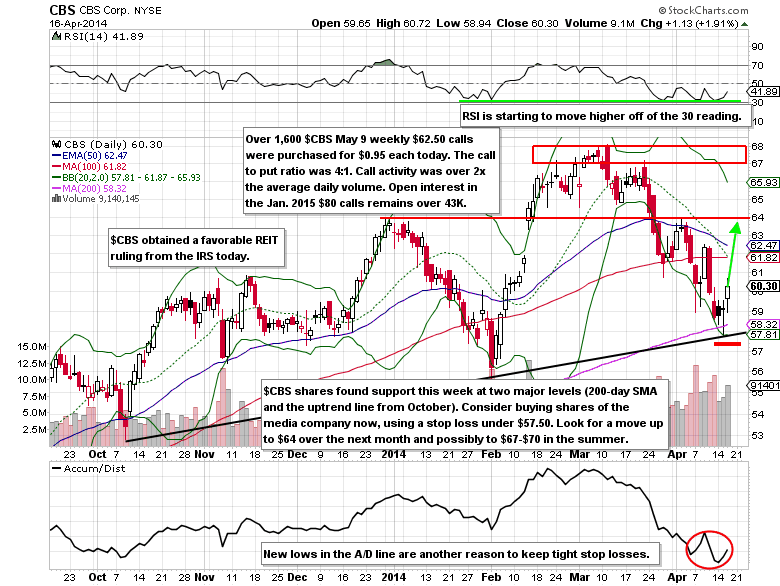

Before the announcement of the IRS ruling, more than 1,600 May 9 weekly $62.50 calls were purchased for $0.95 each. The call to put ratio was 4:1 for the day. Call activity was over two times the average daily volume. Open interest in the Jan. 2015 $80 calls is currently 43,369, which is by far the most of any CBS option. Breakeven on these calls is over 33% from current levels.

TECHNICAL TAKE

Shares of CBS have been in the process of putting in a higher low this week at two major support levels (200-day simple moving average and the uptrend line from October). From the December highs to the February lows, the decline was 13.04% compared to this correction low of 15.21%. The reward/risk ratio on the long side is currently over 3:1. Consider buying shares of the media company now, using a stop loss under $57.50. Look for a move into the high $60’s over the next 2-4 months.

CBS OPTIONS TRADE IDEA

Buy the (CBS) May 17 $60/$65 call spread for a $1.70 debit or better

(Buy the May 17 $60 call and sell the May 17 $65 call, all in one trade)

Stop loss- None

First upside target- $3.40

Second upside target- $4.80

= = =

Mitchell’s Free Trade of the Day featuring Ford Motor (F)