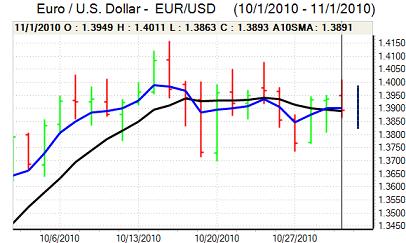

EUR/USD

The Euro was unable to break above the 1.40 level ahead of the US open on Monday and edged weaker with markets still looking to cover excessive short dollar positions ahead of major event risk this week.

The data on US consumer spending was generally weaker than expected with spending rising 0.2% for September as personal income contracted.

In contrast, the ISM index for the manufacturing sector was significantly stronger than expected with a rise to 56.9 for October from 54.4 the previous month. There was a strong rebound for the orders component, fuelled in part by buoyant export demand, while the employment index was also firm.

The data overall is likely to create some additional doubts within the Federal Reserve whether a further injection of quantitative easing is justified at this time. US Treasury yields rose following the data release which also provided some indirect dollar support.

Prospective Fed policy actions will continue to dominate in the short term with an announcement due on Wednesday. There is still a high degree of uncertainty surrounding their policy moves and volatility is likely to be very high following the event.

The dollar will gain strongly if there is no move to expand bond purchases at this time or the Fed signals a very clear exit strategy, but underlying sentiment remains negative and the Euro found support above 1.3850 with a move back to 1.3920.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

After the price spike in Asian trading on Monday, the dollar lost all its gains and re-tested support levels near 80.20 ahead of the US open with reduced speculation that there had been any intervention by the Bank of Japan. The dollar gained some support following the US data as US yields strengthened with a move to the 80.60 area.

Bank of Japan minutes from the October meeting recorded that members were concerned over the risk of a downturn in longer-term inflation trends which will maintain pressure for a very loose monetary policy and there will be speculation of additional central bank action at this week’s meeting.

Finance Minister Noda stated that the Ministry was ready to take decisive action if necessary but, again, there was no evidence of actual intervention in the market with the dollar holding near 80.50.

Sterling

Sterling held firm in Europe on Monday with underlying confidence remaining higher. The UK PMI index for manufacturing was stronger than expected with a gain to 54.9 from 53.4, the first monthly advance since May.

The data maintained the run of generally favourable data for the economy as a whole even though the housing-sector releases have been much less favourable. Taken as a whole, the data will tend to strengthen market expectations that the Bank of England will decide against any further near-term quantitative easing.

The shift in expectations over monetary policy will maintain the more favourable Sterling sentiment in the near term and the UK currency maintained a position comfortably above the 1.60 level against the US dollar while the Euro dipped to below 0.87.

Swiss franc

The Swiss PMI index was slightly weaker than expected with a 59.2 reading for October from 59.7 the previous month which will maintain speculation over an economic slowdown, although the data is still strong in historic terms.

The franc held steady for much of the European session, but then weakened sharply following the US ISM data. The franc lost support on yield grounds and there will be a further suspicion that the National Bank was quietly engineering a weaker currency as the dollar peaked around 0.9970.

Significantly, the franc failed to gain any increased degree of support when there was a widening of Euro-zone yield spreads, but sentiment could still reverse quickly and the dollar failed to hold its best levels.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

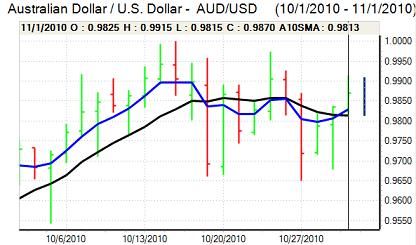

Australian dollar

The Australian dollar found support close to the 0.98 level against the US currency on Monday and consolidated ahead of the Reserve Bank interest rate decision with a slightly firmer tone as risk appetite was solid.

In the event, the central bank announced a further 0.25% increase in rates to 4.75% and the Australian currency spiked higher following the announcement with a renewed push to near parity.

There will be some concerns that the economy could weaken sharply which may deter Australian dollar buying interest to some extent.