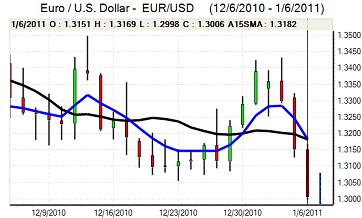

EUR/USD

The Euro was unable to make further headway in Europe on Thursday despite strong manufacturing data from Germany and in a repeat of recent trading behaviour it weakened sharply during US trading.

Although the German data has remained strong, there are major doubts surrounding the Euro-zone economy as a whole and a weak retail sales reading reinforced the fears that budget tightening would undermine growth and keep peripheral countries in recession. There was also a renewed widening in yield spreads during the day which also had an important negative impact on the Euro, especially with unease over the heavy debt issuance which is scheduled for next week.

US jobless claims rose to 409,000 in the latest week from 391,000 previously, but the underlying trend remains encouraging. There has been further optimism surrounding Friday’s crucial non-farm payroll report and, although the dollar has benefitted from an upward trend in consensus forecasts, the currency will be vulnerable to some selling pressure if the data is disappointing.

Markets will also take note of the US debt-ceiling debate with several Republican lawmakers opposed to the Treasury’s request. Although the situation is not yet urgent, divisions over the issue will remind investors of the underlying US fundamental weaknesses.

For now, US growth prospects and Euro-zone debt worries remain dominant and the Euro weakened to fresh 14-week lows around 1.2970 before correcting slightly on reports of strong buying support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to below 83 against the yen during Thursday and edged stronger to the 83.35 area with ranges considerably narrower than the previous day as consolidation was the major theme.

The dollar is continuing to gain support from expectations of firmer growth and a rise in bond yields and the US currency will gain further support if there is a robust US employment-report reading while any figure below 100,000 could trigger sharp US currency losses.

The latest capital-account data indicated there were net outflows from Japan in the latest week and the yen will tend to lose ground when risk appetite improves. There will still be caution over the US and Euro-zone fundamentals which will tend to limit selling pressure on the Japanese currency.

Sterling

Sterling hit resistance just above 1.5550 against the dollar in Europe on Thursday and then retreated rapidly as volatility levels remained high.

The UK services-sector index was sharply weaker than expected with a decline to 49.7 for December from 53.0 the previous month. The economy was hampered by adverse weather conditions, but there will also be concerns over the underlying stresses within the sector, especially with new-business conditions weak. The data will tend to undermine confidence in the economy, especially with persistent doubts surrounding the housing sector.

The UK currency will still tend to gain protection from serious stresses within the Euro-zone, but the situation will reverse rapidly if there are renewed stresses in the banking sector.

From a low near 1.5460, the UK currency initially rallied back to near 1.5550 before weakening back to 1.5450 as there were strong gains for the US dollar. Sterling remained very firm against the Euro with a peak just beyond 0.84.

Swiss franc

The dollar tested resistance levels just above 0.97 against the franc during Thursday, but it was unable to break higher and dipped sharply to near 0.9620 before consolidating near 0.9650. There were renewed franc gains on the crosses with the Euro weakening to lows near 1.2520.

The franc gained fresh support from Euro-zone stresses as yield spreadss widened and it will still be the ultimate safe-haven currency. More general franc buying will tend to be restrained by the general improvement in confidence surrounding the global economy and risk appetite.

Swiss consumer prices were unchanged for December with a 0.5% annual increase which will tend to ease deflation fears slightly and ease demands for a weaker franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

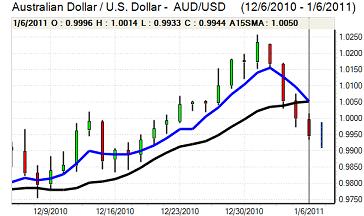

Australian dollar

The Australian dollar was unable to regain parity against the US currency during Thursday and came under sustained pressure during the New York session with lows just below 0.9920. The US Australian currency was hampered by a generally firm US currency while gold prices also remained under pressure which had a negative impact.

There will be further unease over the domestic economy following the weak PMI data, especially with expectations of further damage related to the flooding. There was still buying support on dips given hopes for a stronger global economy.