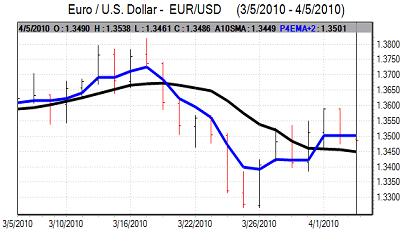

EUR/USD

The Euro edged slightly weaker towards 1.3550 against the dollar ahead of the US payroll data on Friday. The headline payroll increase was slightly weaker than expected with a gain of 162,000 for March following a revised 14,000 decline the previous month while unemployment was unchanged at 9.7%. There were mixed elements within the report, but there was a gain in weekly hours which will provide some degree of confidence surrounding the economy.

There was speculation that the Federal Reserve would increase the discount rate on Monday and this helped support the dollar with gains to 1.3470, but the US currency was struggling to make strong headway as firm risk appetite also tended to draw funds away from the dollar. European markets remained closed for the Easter holiday.

The US data on Monday was stronger than expected with the ISM non-manufacturing index rising to 55.4 for March from 53.0 the previous month and this was the strongest figure since May 2006 while the employment index pushed to near the 50 level. There was a rise in pending home sales of 8.2% for February and the data overall maintained confidence in the economy.

The dollar still found it difficult to gain strong support, especially with strength in commodity currencies as oil prices rose and risk appetite remained strong. The Euro was unable to sustain a move above the 1.3520 level and consolidated around 1.3480 as there was no move by the Fed to change the discount rate.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen came under renewed pressure following the US employment data on Friday with an advance to fresh 8-month highs around 94.70. the dollar edged slightly lower, but the yen was initially unable to make much headway on Monday as the dollar found support just below 94.50.

There was further evidence of exporter selling during the day and the US currency dipped to lows near 94 before correcting back to 94.25 while the Euro was blocked towards the 128 area against the Japanese currency.

Global risk appetite was generally firm which helped curb underlying yen demand during the day.

Sterling

The UK currency dipped from the 1.5250 area to lows below 1.52 against the dollar following the US payroll report on Friday, but found support below this level and was above 1.52 on Monday as there were gains against the Euro to 1-month highs.

The weekend opinion polls suggested there was a reduced risk of an indecisive parliamentary election result and this helped underpin the UK currency. Sterling also gained support from a general degree of confidence in the global economy as equity markets rallied further. UK markets remained closed on Monday which tended to stifle Sterling moves to some extent.

The improvement in risk appetite remained an important influence and Sterling pushed to a high just above 1.53 against the dollar before consolidating just below this level.

Swiss franc

The dollar pushed to highs above 1.0650 against the franc following the US employment data on Friday, but was struggling to hold gains and the US currency was trapped in relatively narrow ranges on Monday as it found support on dips towards the 1.0580 level.

The Euro held just above the 1.43 level on Monday and there was speculation of National Bank Euro buying close to the 1.43 level which helped prevent further losses for the currency against the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

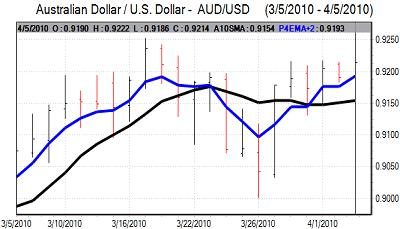

Australian dollar

Risk appetite was still broadly firm during Friday which helped underpin the Australian dollar and it also remained close to 0.92 against the US currency on Monday. The Tuesday Reserve Bank interest rate decision will be an important focus and it is likely to be a very close decision.

Failure to increase rates from 4.00% now would tend to push the Australian currency weaker, but losses could be reversed quickly if underlying global risk appetite remains firm.