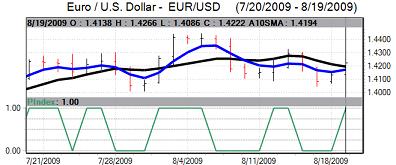

EUR/USD

The Euro has continued to probe technical support and resistance levels over the past 24 hours, but markets have been unable to break down these levels. The Euro strengthened in European trading on Thursday, supported in part by an upgrading of near-term German growth forecasts by the Bundesbank. There was also further near-term optimism surrounding the Euro-zone bond auctions, but, as during the previous sessions, the Euro was unable to sustain a move above the 1.29 level.

The US economic data was significantly weaker than expected as jobless claims rose to 500,000 in the latest week from a revised 488,000 previously. This was the highest reading since February and will reinforce unease over US labour-market trends. In addition, the Philadelphia Fed manufacturing index fell to -7.7 for August from 5.1 in July.

Although prone to considerable volatility, there will also be fears that the manufacturing sector could come under further stress. Given that an industrial recovery has been an important leader in the overall recovery, there will be further doubts over the economy as a whole.

There was a notable deterioration in risk appetite following the US data as equity markets were subjected to renewed selling pressure. There was also defensive dollar demand and the US currency strengthened to test levels near 1.28 against the dollar. The Euro was able to find support just below this level and consolidated with a weaker bias.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was subjected to renewed selling pressure following the US data releases on Thursday with a test of key support close to the 85 level. The US currency managed to resist a decline through this level and recovered to the 85.5 area with some evidence of semi-official dollar buying during the day.

The yen continued to gain underlying support from reduced confidence in the global economy with notable caution over carry trades.

With the yen at very sensitive levels, comments from senior Japanese officials remain under close scrutiny. Finance Minister Noda stated that the Ministry was watching market developments closely. The Bank of Japan indicated that it was still assessing the impact of yen strength.

Although firm Asian currencies will hep protect competitiveness, there was heightened speculation that a decision would be made to intervene and the dollar was able to resist a further test of support close to 85.

Sterling

Sterling volatility has remained high over the past 24 hours with further buffeting from domestic economic data and global trends.

The data releases was better than expected with retail sales rising by 1.1% for July while there was a firmer reading for the latest CBI industrial orders survey.

In addition, the latest government borrowing requirement recorded a deficit of GBP3.2bn for July from GBP13.9bn the previous month. The monthly deficit was also lower than the previous year’s figure which increased optimism towards the structural outlook, at least in the near term.

Sterling was hampered by the deterioration in risk appetite, hitting resistance above 1.5650 against the dollar and retreating back to below 1.56 as the US currency secured defensive demand.

Swiss franc

The franc has secured further gains over the past 24 hours and advanced to a high just beyond 1.0250 against the dollar during the US Session on Thursday. There was notable franc support on the crosses with the pushing to a high beyond 1.32 against the Euro.

Domestically, there was a record trade surplus for July which helped lessen immediate fears surrounding export competitiveness. There was also a recovery in the ZEW business confidence index to 9.1 for August from 2.2 the previous month.

The franc gained notable support on safe-haven grounds as confidence in the global economy deteriorated in line with weak US economic data releases and caution is liable to prevail for now.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

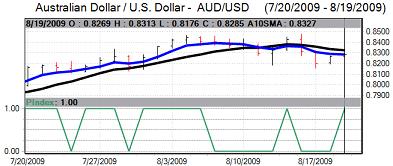

Australian dollar

The Australian dollar was unable to make any headway against the US dollar during Thursday and there was important selling pressure following the US data as risk appetite deteriorated. From highs close to 0.9020, the currency weakened to lows just below 0.89 against the US dollar.

Risk conditions are liable to remain dominant in the near term and underlying confidence is liable to remain generally fragile given increased doubts over the global outlook. Optimism over some strength in the Asian economy may help curb aggressive selling pressure in the near term.