EUR/USD

Markets were inevitably frozen within relatively narrow ranges ahead of the US payroll data on Friday with the Euro holding close to 1.4150 against the dollar.

The headline US employment data was slightly stronger than expected with a payroll increase of 216,000 in the latest month from a revised 194,000 previously while the unemployment rate dipped again to 8.8% from 8.9%. The report, overall, suggested solid growth for the economy, especially as private-sector growth had to compensate for a further decline in government jobs.

The ISM manufacturing index also maintained a strong reading at 61.2 from 61.4 the previous month.

The dollar advanced following the data, but reversed course later in the US session as monetary policy expectations also remained extremely important. Federal Reserve Governor Dudley was significantly more dovish than other recent Fed members as he stated that the time was not yet right for a tightening of policy. Debate within the Fed will be extremely important for the dollar running into the FOMC meeting later this month as there are growing divisions within the committee. Markets will be on high alert for further comments from key Fed officials with a particular focus on Chairman Bernanke.

The Euro continued to gain support on expectations that the ECB would increase interest rates this week. There was still some speculation over a 0.50% increase and also further talk that the central bank would indicate a series of increases. The Euro pushed to a high near 1.4250 against the dollar and briefly pushed above this level in Asia on Monday before edging lower. Markets will still watch Euro structural developments and sovereign default risk closely with volatility liable to remain at elevated levels.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar jumped higher following the US payroll data on Friday with a high just above 84.50 against the Japanese currency, but the US currency did run into profit taking, especially after a strong advance during the week, especially as it lost ground heavily against the Euro and Sterling.

Risk appetite remained generally strong following the data which increased market interest in carry trades and also boosted retail demand for overseas currencies. These factors tended to weaken the yen and there was initial dollar support from higher Treasury yields.

The latest data recorded a sharp increase in Japan’s monetary base and there will be further expectations that the Bank of Japan will effectively finance additional government spending by monetising the debt. In the medium term, this could be the source of major downward pressure on the Japanese currency.

Sterling

Sterling remained generally fragile in European trading on Friday and was subjected to further selling pressure following a weaker than expected PMI report for the manufacturing sector. The index declined to 57.1 from a revised 60.9 previously and, although still robust in historic terms there were increased fears that the economy is losing momentum.

The construction and services-sector PMIs will be watched very closely this week and monthly declines would raise further questions over the economy’s health.

The Bank of England will remain an important near-term focus with the latest MPC decision due on Thursday. The shadow MPC, which is made up of academic economists voted 5-4 to hold interest rates steady and there is also likely to be a close vote at the real MPC meeting. Markets will be expecting rates to be left on hold, but there will certainly be caution given the possibility of an increase.

Sterling retreated to below the 1.60 level against the dollar after the US payroll data before reversing course and pushing back above 1.61 as the US currency came under fresh selling pressure.

Swiss franc

The dollar consolidated above 0.9220 against the US currency on Friday before the US data helped spark a further spike in volatility as the US currency advancing to highs around 0.9325 before reversing course and retreating back to the 0.9240 area.

The Swiss currency was significantly weaker on the crosses as the Euro pushed to a high above 1.3150. There was greater confidence in the global economy as risk appetite also improved and this was important in lessening demand for the Swiss currency as carry-trade activity increased even though there were further stresses surrounding the Euro-zone sovereign-debt risks.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

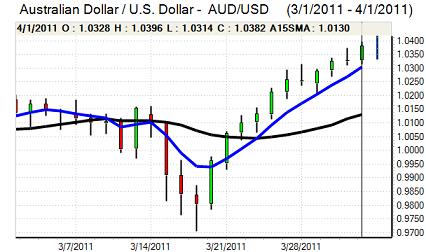

Australian dollar

The Australian dollar retreated in an immediate response to the US employment report, but it regained ground quickly and challenged fresh 29-year highs above the 1.04 against as the US currency reversed course later in the US session.

The Australian currency continued to gain support from the general improvement in risk appetite as markets looked to take an optimistic tone towards the global economy with carry trades seen as increasingly attractive given the yield advantage. The domestic data recorded a further increase in job advertisements and the inflation gauge, but the market impact was limited.