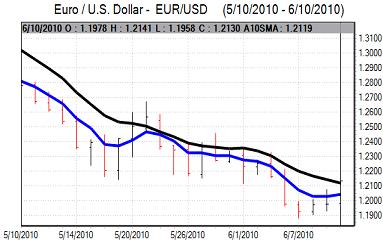

EUR/USD

The Euro again found support above 1.1950 against the dollar during Thursday and maintained a generally firmer tone as it probed resistance levels last seen following the June US payroll data.

As expected, the ECB left interest rates on hold at 1.0% following the latest council meeting. Principal attention focussed on the special policy measures and the central bank press conference following the meeting. There were no additional liquidity measures announced and bank President Trichet stated that the measures enacted so far were strictly temporary in nature and did not represent quantitative easing. Trichet also commented that the Greek budget deficit appeared to be on track for the first five months of the year.

Trichet’s comments were clearly designed to bolster confidence in the Euro-zone economy and Euro while providing reassurance to global investors. There was a short-term favourable Euro reaction on the comments while the currency also gained traction from an improvement in global risk appetite. It will still be difficult to sustain the mood of improved confidence, especially if institutional Euro demand starts to fade again.

The US economic data was slightly weaker than expected as jobless claims only fell marginally to 456,000 in the latest reporting week from a revised 459,000 previously which suggests that labour markets are still relatively weak. The trade deficit also rose to a 16-month high of US$40.3bn for April while the May federal budget remained firmly in deficit.

The US fundamentals will continue to give cause for concern and will limit the scope for dollar gains. As a covering of short positions continued, the Euro rose to a high around 1.2140 and held firm late in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk appetite was generally firmer in Asian trading on Thursday with confidence in the global economy boosted by confirmation of a strong Chinese export performance for May. There were also renewed gains for the Australian dollar which helped sustain interest in carry trades and tended to weaken the yen.

Domestically, an annual rise in wholesale prices and firmer consumer confidence could have a small positive yen impact, but the impact is likely to be limited. The yen lost some ground on the crosses, but the dollar was unable to take advantage and remained around 91.25.

The yen was hampered by an improvement in risk appetite during the US session and the dollar found support below 91, but it was unable to make any significant headway.

Sterling

Sterling held firm in early Europe on Thursday ahead of key domestic and European events during the day. The Bank of England left interest rates on hold at 0.50% following the latest MPC meeting and there was no expansion of the quantitative easing programme.

The bank also decided not to issue a statement following the meeting and this will tend to curb Sterling support to some extent as the bank is likely to warn markets before any potential rate increase. The lack of comments suggest that the bank is not looking for an immediate tightening which will maintain some fears over longer-term valuations.

The underlying fiscal and monetary policy mix will remain unfavourable for Sterling, but it will continue to gain important support from a lack of confidence in other key economies.

Trends in risk appetite remain important and Sterling will gain some support when confidence in the global economy improves. As the dollar also faded, the UK currency was able to push to highs around 1.47 while it remained stronger than 0.83 against the Euro.

Swiss franc

The dollar was unable to make much headway against the Swiss franc on Thursday, but it did find support close to 1.14 and edged slightly higher later in the US session. In contrast to recent sessions, the Euro was able to make some headway against the Swiss currency.

There will be relief that the ECB has managed to shore-up near-term Euro confidence, but underlying sentiment is still likely to be very fragile which will limit franc losses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

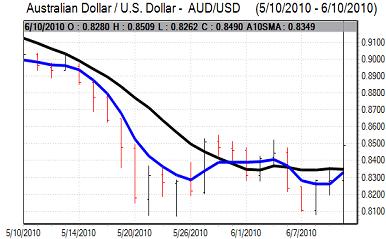

Australian dollar

There was firm Australian dollar buying support close to 0.8250 and the currency rebounded to a high near 0.8390 on Thursday. Confirmation of strong Chinese export growth helped boost confidence in the Asian economy and boosted optimism over Australian trade prospects. There is still likely to be a high degree of caution over risk appetite which will tend to curb Australian dollar buying support.

Near-term relief over economic and market developments offset these background doubts and the Australian dollar rallied to a peak above 0.85 against the dollar in US trading.