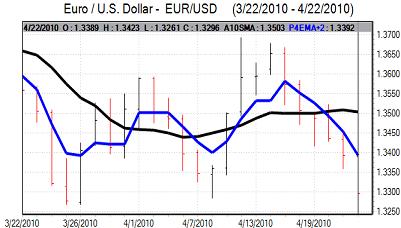

EUR/USD

Selling pressure on the Euro continued in early Asia on Friday with 12-month lows close to 1.32 as there was a fresh round of stop-loss selling following the break of 1.3260. There was a recovery back to 1.3280 in Europe with the German IFO index showing a significant improvement as the business confidence index rose to 101.6 for April from 98.2 the previous month.

The economic trends still found it difficult to drag attention away from the structural weaknesses as the Greek debt situation remained under very close scrutiny.

Following a bout of rumours, the Greek government announced that it had formally applied for assistance under the EUR45bn EU/IMF aid package agreed last month. Following the announcement, there was some relief as Greek yield spreads over German bunds narrowed. Underlying confidence was extremely fragile as structural fears remained an important background focus.

The US new home sales data was stronger than expected with an increase to an annual rate of 411,000 for March from a revised 324,000 the previous month. The durable goods orders data was mixed as a headline decline in orders was offset by a sizeable underlying increase as a significant decline in aircraft orders undermined the headline figure. There was some speculation that the Fed would move to a tightening bias at next week’s FOMC meeting, butt he dollar was unable to draw much benefit.

The Euro found support below 1.33 in the US session and a round of short covering pushed the currency to highs around 1.3380.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Asian equity markets were generally more resilient on Friday which curbed yen support, but there was still caution over selling the yen. The Australian dollar was weaker following comments from the Reserve Bank Governor that interest rates were close to an average level which dampened carry-related outflows from Japan.

The dollar hit resistance above 93.50 and edged slightly lower with the yen remaining firm against the Euro.

The dollar maintained a firmer tone in US trading with gains to a two-week high around 94.30 on additional yield support relative to the Japanese currency. The Euro also regained the 125 level as there was persistent interest in selling the yen.

Sterling

The UK currency held steady against the dollar in early Europe on Friday. The latest GDP data was weaker than expected with a preliminary figure of 0.2% growth for the first quarter compared with expectations of a 0.4% advance.

This will dampen confidence in the economy to some extent, although the impact may be measured as the data was liable to have been pushed down by bad weather conditions and markets will wait for further developments surrounding economic surveys.

The political developments will also remain in focus and the latest opinion polls will be watched closely over the weekend. Sterling support will be fragile if there is continuing evidence of a deadlocked result, but selling pressure should be contained unless there are warnings over the credit-rating outlook.

Sterling was unable to regain the 1.54 level against the dollar and there was a significant Euro recovery against Sterling to the 0.87 area after heavy losses this week.

Swiss franc

The dollar pushed to a high of 1.0850 against the Swiss franc in European trading on Friday, but it was unable to hold its best levels and retreated significantly to 1.0730 later in the US session.

The Euro was able to strengthen slightly to the 1.4350 area, but the gains lagged behind the Euro’s advance on the other major currencies.

Underlying confidence in the Euro-zone will remain fragile which will continue to provide background support for the franc. In contrast, optimism over the global growth outlook will tend to curb Swiss currency support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

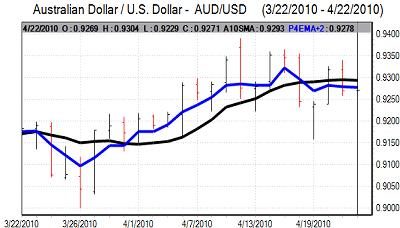

Australian dollar

In comments on Friday, Reserve Bank Governor Stevens stated that interest rates were close to an average level which dampened expectations of further near-term interest rate increases. The remarks also curbed support for the Australian dollar and it retreated to lows around 0.9170 against the US dollar.

The US currency retreated in New York and the Australian dollar was able to recover to the 0.9265 area as risk appetite also improved.