EUR/USD

The dollar edged higher ahead of the US open on Wednesday, but was unable to make strong headway as resistance levels held.

The US retail sales data was stronger than expected with a 1.6% in headline sales for March after a revised 0.5% increase the previous month. There was also a solid 0.6% increase in underlying sales for the month which maintained optimism over the near-term economic outlook.

The consumer prices data failed to have a significant impact with a 0.1% increase in prices for March while the core rate was slightly weaker than expected with no change in prices for the month to give a 1.1% annual increase. Despite important medium-term reservations, the data will not increase market fears over the inflation outlook.

Fed Chairman Bernanke issued a generally cautious commentary on the US economy. He was confident that the economy was improving, but also expressed concerns that growth was being held back by significant restraints. Again, there was no evidence of an early move to tighten policy which tended to limit dollar support. Demand for the US currency was also sapped by generally robust risk appetite during the day.

The Fed’s Beige Book reported that conditions had improved in all bar one of the Federal Reserve districts. Retail sales had generally improved, but credit demand remained weak.

Immediate fears surrounding the Euro-zone economy and Euro remained lower following the Greece loan package and this helped underpin the Euro during the day with the currency moving higher to the 1.3660 region later in New York trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk appetite was generally firmer in Asian trading on Wednesday with equity markets firmer following better than expected results from Intel and this curbed yen demand. The Singapore MAS announced a revaluation of the Singapore dollar which also helped underpin risk appetite. The impact is likely to be mixed as there will also be increased speculation that the Chinese authorities will move to let the yuan appreciate which could also provide some support for the Japanese yen.

With demand for both the dollar and yen weaker on risk conditions, the US currency was able to hold above the 93 level in Asian trading.

The dollar struggled to sustain gains following the stronger than expected retail sales data and dipped to lows near 92.80 following the generally dovish remarks from Bernanke. There was still significant yen selling on rallies and the dollar edged back to the 93.25 area.

Sterling

Sterling edged firmer against the dollar on Wednesday and the currency should continue to gain some near-term support from an underlying improvement in global risk appetite, especially if there are further gains for commodity prices.

With no major economic releases, opinion polls will continue to be watched closely and Sterling will tend to be held back unless there is evidence that a decisive May 6 election result looks more likely.

It is also the case that a considerable amount of bad news has been priced in and this may prevent heavy selling pressure in the run-up to the election unless there are fresh warnings over the risk of a credit-rating downgrade.

The US currency was generally on the defensive during Wednesday which helped underpin Sterling and it pushed to a 7-week high near 1.55 against the dollar in New York trade.

Swiss franc

The dollar was unable to make any headway against the franc on Wednesday and dipped to lows near 1.05 in New York as underlying demand for the currency remained subdued. The Euro was unable to regain significant ground following losses over the first two days of the week, but it did find support below 1.4350 against the Swiss currency as immediate Euro-zone fears eased.

Generally strong global risk appetite should have some impact in curbing demand for the Swiss franc, but the currency is still proving to be resilient as underlying selling pressure remains limited.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

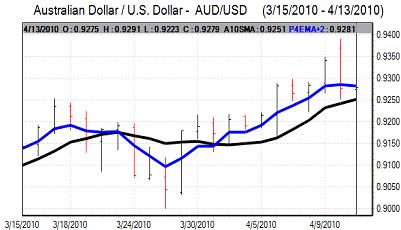

Australian dollar

The Australian data remained slightly disappointing with a dip in consumer sentiment and there will be some doubts over the economic trends which will tend to undermine the US currency.

Overall risk appetite can remain strong in the short term with confidence over the Asian economy and this should also provide support for the Australian dollar, especially if commodity prices remain high. The Australian currency edged higher towards the 0.9350 area during New York trading.