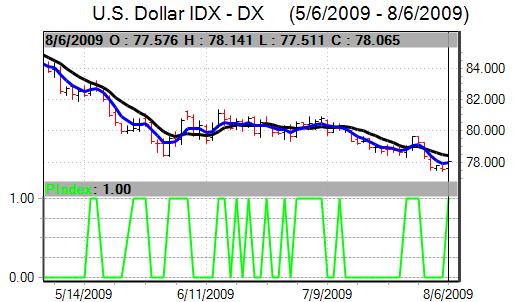

The dollar weakened to 2009 lows over the first half of the week as underlying sentiment remained weak and players looked to break currencies out of recent ranges. The US currency found some support at lower levels as confidence in European currencies faltered and then edged stronger ahead of the US payroll data.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Risk appetite was still firm which tended to curb dollar demand, although there was evidence of greater caution over the second half of the week.

The US ISM manufacturing index was stronger than expected with an increase to 48.9 for July from 44.8 the previous month. The orders component continued to improve and the pace of job cutting also slowed sharply over the month which will reinforce optimism over a further recovery in the manufacturing sector.

There was also a stronger than expected with a 3.6% increase in pending home sales for June following a revised 0.8% rise the previous month as lower prices continued to attract buyers into the market.

There was a 371,000 decline in private-sector employment according to the latest ADP survey compared with expectations of a 345,000 decline, although this was still a significant improvement from the previous month. The number of planned job cuts also increased for the month.

The headline US jobless claims data was stronger than expected with a dip to 550,000 in the latest week from a revised 588,000 the previous week while continuing claims were higher than expected.

The monthly employment data recorded a 247,000 decline in payrolls for July after a revised 443,000 decline the previous month while the unemployment rate fell to 9.4% from 9.6%, the first decline for 15 months.

The services-sector data was less supportive as the ISM index dipped to 46.4 for July from 47.0 the previous month, contrary to expectations of a monthly recovery. The orders and employment components also declined over the month. There were also some continuing fears over underlying trends in the banking sector.

The German factory orders data was sharply stronger than expected with a further 4.5% increase for June following a 4.4% increase the previous month, maintaining optimism over a recovery in the industrial sector, although the Italian output data was weaker than expected.

As expected, the ECB left interest rates on hold at 1.0% following the latest council meeting. Bank chairman Trichet also took a generally neutral stance in the press conference following the meeting with some cautious optimism over a gradual recovery in conditions. Trichet made no significant reference to the Euro’s value.

The Euro strengthened to nine-month highs above 1.44 against the dollar during the week and also pushed to near 2009 highs against the yen before correcting slightly weaker.

The yen was again unable to strengthen through the 94 region against the US dollar and weakened to 96.50 following the US employment data.

The latest capital account data also recorded net outflows by Japanese investors into overseas high-yield instruments and these flows will remain an important negative influence for the Japanese currency.

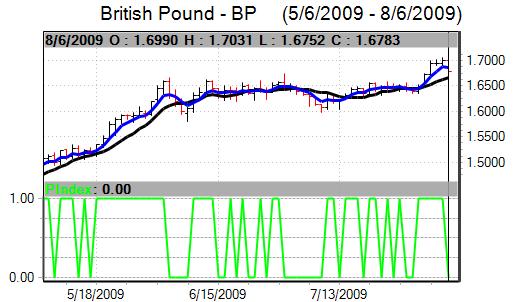

The UK economic releases were generally favourable which provided initial currency support as confidence in the recovery increased. The Halifax house-price index rose 1.1% for July, maintaining the recent run of favourable housing-sector data.

The manufacturing PMI data was stronger than expected with an increase to 50.8 in July from 47.4 previously. This was the strongest reading and the first above the pivotal 50.0 level since March 2008

The PMI index for the services sector rising to 53.2 in July from 51.6 the previous month while there was a 0.5% increase in industrial output for June as car output recovered from the earlier shutdowns while construction activity fell at a slower rate.

The interest rate decision from the Bank of England was no surprise with rates left on hold at the 0.50% level. The decision on quantitative easing was a surprise, however, as the bank announced an increase in the corporate bond buying programme. A further GBP50bn will be bought over the next three months, taking the total to GBP175bn.

The bank was very cautious over the economic outlook, warning that the financial sector was still extremely fragile while the recession would be deeper than expected. The move to increase quantitative easing was negative for the currency and the bank’s comments also dampened the optimism triggered by recent favourable data releases.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Sterling strengthened to 10-month highs against the dollar with a challenge on resistance levels above 1.70 while the UK currency also pushed to near 2009 highs against the Euro before losing ground.

Following the Bank of England move, Sterling weakened sharply to lows near 1.6750 against the dollar with the Euro back above the 0.8550 level.