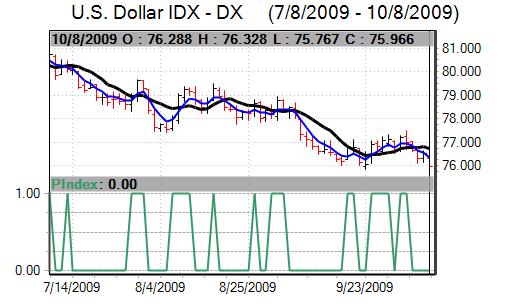

The dollar remained a key market focus during the week. The US currency attempted to correct stronger at times, but generally remained on the defensive as rallies quickly attracted fresh selling pressure. The US currency tested 2009 lows before staging a limited recovery on Friday after Bernanke’s comments.

Overall confidence in the US fundamentals remained weak amid further speculation over reserve diversification. The dollar was unsettled by a media report that Gulf producers would look to switching oil pricing to a basket of currencies.

The US ISM index for the non-manufacturing sector rose to 50.9 from 48.4 the previous month and this was the strongest reading for over 12 months, although there was still evidence of underlying vulnerability.

The US remaining economic data was slightly stronger than expected with jobless claims falling 521,000 in the latest week from a revised 554,000 the previous week which will maintain some cautious optimism that the labour market is at least stabilising. The US dollar was still tending to lose support on reduced defensive demand as confidence in the global economy improved.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Fed officials gave broadly neutral comments for much the week. Fed Chairman Bernanke then commented that monetary policy would need to be tightened as the economic recovery took hold and speculation over an early move to increase interest rates gained some renewed traction which helped support the dollar.

There was further verbal intervention by European officials with Portuguese officials, for example, warning that the Euro’s value was not in line with fundamentals.

There was some further unease over the situation in Latvia amid fresh rumours of devaluation and this is likely to have some negative Euro impact.

As expected, the ECB held interest rates at 1.0% following the latest council meeting. In the press conference following the meeting, President Trichet was generally slightly more optimistic on the economy with a suggestion that downside risks were starting to ease, although there was no suggestion of an early move towards tightening.

Trichet continued to express confidence in a strong US dollar policy which was broadly in line with recent comments and there was no aggressive warning over the Euro’s value. As usual, Trichet also refused to comment on the possibility of joint intervention in the currency markets. The measured stance on the Euro will dampen any expectations of near-term action to weaken the currency and also suggests that the bank does not consider that the currency is in the danger zone at current levels.

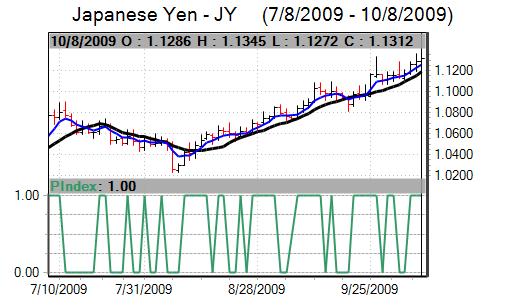

The Euro pushed to highs just above 1.48 against the dollar before a limited correction. The dollar was unable to gain any significant traction against the yen during the week and weakened to test important support levels close to 88. There was evidence of institutional dollar buying support close to this level and the US currency was able to stage a limited corrective recovery towards 89.20

Finance Minister Fujii was reported as saying that the government would be open to intervention on outrageous and reckless exchange rate movements. There was still a high degree of uncertainty over official policy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The UK Halifax house-price index recorded a further 1.6% monthly increase for September, maintaining the run of generally favourable housing-sector releases. The services-sector PMI index was also stronger than expected with a move to a two-year high of 55.3 for September from 54.1

In contrast, the industrial data was sharply weaker than expected with a 2.5% monthly decline for August. Although the data may have been distorted by the timing of Summer production shutdowns, the very sharp decline will maintain fears over the industrial sector.

The NIESR reported that the economy recorded no growth in the three months to September following a revised 0.1% increase the previous month. The actual data being recorded still appears to be in significant contrast to the survey evidence which will tend to maintain a defensive stance towards the UK economy and assets.

The Bank of England left interest rates on hold at 0.50% following the latest policy meeting which was in line with expectations. The amount of quantitative easing was also left on hold at GBP175bn with the bank expecting that the programme of bond purchases will be completed within the next month.

The bank stated that all possibilities will be examined once the programme has been completed. The November MPC meeting will, therefore, be very important both for the bank and for Sterling direction over the remainder of 2009.

Sterling remained under selling pressure over the first half of the week and the trade-weighted index dipped to a five-month low while there was a test of support below 1.59 against the dollar while Sterling dipped to lows near 0.93 against the Euro. The currency was able to secure some respite later in the week, although selling interest on rallies remained a key feature.