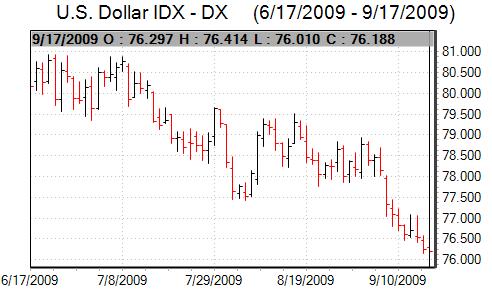

US currency weakness remained the dominant market theme during the week. The US dollar attempted to rally at times, but generally remained on the defensive with 12-month lows on a trade-weighted index while the US currency also weakened to 2009 lows against the Euro before a limited recovery.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The US data was generally stronger than expected with a 2.7% surge in retail sales for August. Although driven to a large extent by rising auto sales, there was also a 1.1% underlying increase. The New York manufacturing index also rose further to 18.9 in September from 12.1 the previous month.

There was also a 0.8% production increase for August following an upwardly-revised 1.0% increase the previous month while capacity use rose to 69.6% from 68.5% as output in the auto sector strengthened. US housing starts rose to an nine-month high of 0.60mn for August from a revised 0.59mn the previous month.

The Philadelphia Fed index also rose to 14.1 from 4.1 the previous month which was the highest reading since June 2007, although the underlying components were less reassuring and suggested that the recovery may prove brittle. Initial jobless claims fell to 545,000 in the latest week from 557,000 previously. The data continues to suggest an underlying US recovery, but that there are still important vulnerabilities.

Fed Chairman Bernanke stated that the recession had probably ended. Following recent comments from Fed officials, there was still only limited speculation that the central bank will push for higher interest rates in the short term with expectations of a tightening later in 2010.

The headline US capital account data recorded net long-term inflows of US$15.3bn from a revised US$90.2bn the previous month. There was a significant increase in Chinese and Japanese US Treasury holdings for the month which will provide some degree of relief.

In contrast, there were net private-sector outflows of over US$130bn for the month. The private-sector outflows will pose important underlying risks to the dollar as it suggests an important increase in capital outflows from the US which have historically been important in undermining the currency. The second-quarter current account deficit edged lower to US$98.8bn from US$104.5bn previously.

The German ZEW index was slightly weaker than expected at 57.7 for September which dented the Euro slightly, although this was still an improvement from the 56.1 the previous month and represented a three-year high for the index.

There was a significant trade surplus for July which provided some degree of market support. Euro-group head Juncker suggested that the Euro did not significant risks to the recovery at current levels which dampened any expectations of protests against the Euro’s level. Support was stifled to some extent by unease over the banking sector

The Euro still maintained a generally firm tone over the week, notably against the dollar and Sterling with the highest level against the UK currency since late May.

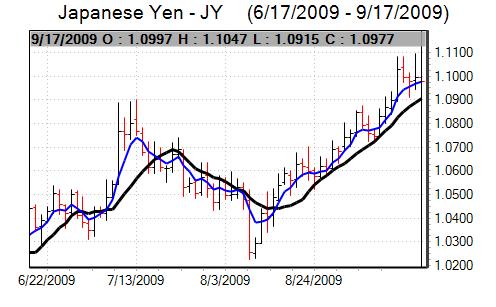

The Japanese currency strengthened to 7-month highs against the dollar during the week with a test of key dollar support close to 90 and was firm on the crosses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Finance Minister Fujii stated that he was opposed in principle to currency intervention which initially pushed the yen stronger towards the 90 level. Bank Governor Shirakawa, also commented that a firm yen could help the economy and the overall thrust of these comments increased speculation that there has been a change in tone by the Japanese authorities.

The headline UK consumer inflation rate edged lower to 1.6% in August from 1.8%, but this was again slightly higher than expected which provided some immediate Sterling support as there will be less pressure for an aggressive Bank of England response, but gains were erased quickly.

Bank of England Governor King stated that a cut in deposit rates on commercial bank reserves is being considered. King was also generally downbeat over economic prospects with a warning of a long haul out of recession which undermined confidence. Overall confidence in the bank’s policies also remained very fragile.

The UK unemployment claimant count rose 24,400 in August which was marginally below market expectations while the ILO unemployment rate rose to 7.9% from 7.8% which was a 14-year high for the series.

Sterling was able to avoid heavy losses against the dollar during the week, primarily due to independent US vulnerability, although there was a softer tone with lows near 1.63. The UK currency also dipped to four-month lows against the Euro near 0.90.

The National Bank held interest rates at 0.25% following the latest quarterly meeting. The bank repeated that it would not tolerate franc appreciation against the Euro and would maintain unconventional measures to support the economy.

There was an upgrade to growth and inflation forecasts for the next two years which suggested that the bank could be less aggressive on policy moving forward, although bank chairman Roth commented that the deflation threat had not disappeared. The net impact was for expectations of a slightly firmer policy than had been expected.

The dollar was unable to gain any momentum against the Swiss currency and dipped to fresh 2009 lows below 1.03 during the week. The Euro hit tough resistance above 1.52 against the Swiss franc.