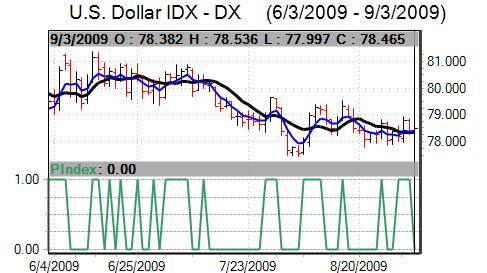

The US dollar gained defensive support at the beginning of the week, but still struggled to gain sustained support and ended little changed for the week as a whole. The principal trigger for the move was a sharp decline in Chinese equity markets with the Shanghai composite index falling by over 6.5% which took the cumulative August fall to over 20%. Markets recovered their poise later in the week, although the US dollar was still able to avoid heavy selling pressure as conviction remained low.

The US Chicago PMI index was stronger than expected with an increase to the 50.0 expansion threshold for August from 43.4 the previous month and this was the highest reading for 12 months. The index was boosted by the increased activity in the auto sector while the employment index remained weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The ISM manufacturing index rose to 52.9 for August which represented the first reading above 50 for 18 months, while the ISM index for the non-manufacturing sector strengthened to 48.4 from 46.4 the previous month. In addition, pending home sales rose by a further 3.2% for July, maintaining the run of favourable housing-sector releases.

The US employment data was weaker than expected with ADP estimating a 298,000 decline in private-sector payrolls for August compared with expectations of around 250,000 although this was an improvement from July’s decline. The data overall was consistent with expectations of a very slow recovery in the economy as a whole with labour markets still very weak and an important barrier to increased spending. jobless claims edged slightly lower to 570,000 from a revised 574,000 the previous week.

The FOMC minutes were broadly consistent with expectations as the Fed warned that the economy would recover only slowly and would be vulnerable to external shocks.

In recent weeks, the dollar has tended to lose ground on favourable releases, but there was a slightly different reaction this time as the dollar gained ground. In part, this was due to hopes that the key US sectors will be able to rebound at a faster pace than Europe, although confidence was again fragile.

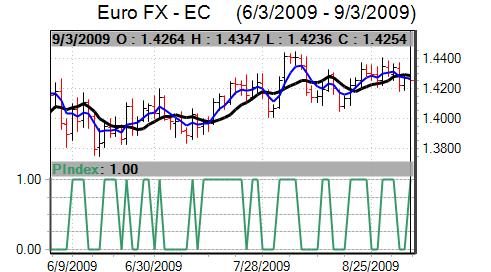

The Euro dipped lower when risk aversion spiked higher and was also unsettled briefly by comments from German Finance Minister Steinbrueck who stated that financing conditions were liable to deteriorate over the next few months. The Euro consolidated near 1.4250 against the dollar and struggled for clear direction on the crosses. The dollar found some support weaker than 1.06 against the Swiss franc.

The flash estimate of Euro-zone inflation was slightly higher than expected at -0.2% for August compared with the -0.7% previously which dampened expectations of a more aggressive ECB monetary policy.

There was no surprise with the ECB interest rate decision as the central bank left rates on hold at 1.00% following the latest council meeting. There was also a small upgrade to the economic projections with marginal growth expected for 2010.

In contrast, bank President Trichet was very cautious over the outlook, warning that risks to the economies remained high despite the signs of stabilisation. Trichet also stated that exit strategies could be discussed, but that this was no time for tightening policy. The ECB also announced that there would be a further unlimited tender of funds at 1.00% following the first allocation in June. Trichet’s overall tone tended to sap confidence in the Euro-zone and limit any potential Euro support.

The dollar weakened to test seven-month lows near 92 against the yen during the week before finding some degree of relief. The yen gained some significant degree of support from a deterioration in risk appetite early in the week.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The Japanese currency also gained support from the opposition DPJ’s weekend general election victory. There was further speculation that the government will move towards a more aggressive currency reserve management policy which would tend to lessen support for the dollar. The positive yen impact was offset to some extent by doubts over domestic fiscal policy as the government remains committed to a further expansion of fiscal spending which would increase he already substantial underlying debt fears.

The UK PMI manufacturing index fell back to below the 50.0 level for August which caused some unease and the lending data also caused significant concern. Consumer lending recorded a net contraction for the first time since 1993 while there was also the biggest net repayment of credit by the non-financial private sector since 1997.

There were further concerns that a lack of credit and an unwillingness to borrow would limit the scope for economic recovery. There were renewed fears over the outlook for government revenues and confidence is liable to remain fragile. The construction PMI report remaining below the 50.0 level for August.

In contrast, the PMI index for the services sector rose to 54.1 for August from 53.2 the previous month and this was the strongest reading for close to two years. Following recent weakness, the data revived some degree of optimism over underlying economic conditions, although confidence was still fragile given the extremely important issue of rising government debt.

Sterling was subjected to renewed selling pressure early in the week with lows near 1.61 against the dollar, but did manage to stage a tentative recovery during the second half as domestic and international factors turned more benign. There was also support weaker than 0.8820 against the Euro.