Risk appetite and conditions within the global economy continued to dominate market sentiment. Dollar Libor rates edged lower over the week and this tended to curb US currency demand to some extent, although the impact was measured as it was offset by a slightly more cautious attitude towards risk.

The Federal Reserve announced the creation of new long-term swap facilities with the other major central banks with the Fed able to draw on these lines for Euros, Sterling, yen and Swiss francs. There will be optimism that the central banks will be better placed to combat any serious currency stability which supported the dollar slightly.

The US trade deficit narrowed to US$26.0bn in February from US$36.2bn previously and this was the lowest figure since November 1999. The IBD consumer confidence data recorded a rise in March to the highest level since November 2008 which continues to suggest that the pace of economic contraction is at least slowing, but jobless claims remained at a very high level of 654,000 with continuing claims at another record high.

The Federal Reserve minutes from March’s meeting recorded that members were divided on the Treasury buying plan announced at the meting. The FOMC was, however, very downbeat in its assessment of economic conditions and these fears persuaded the members that aggressive action was justified. The minutes did not spur greater confidence in the US or global economy.

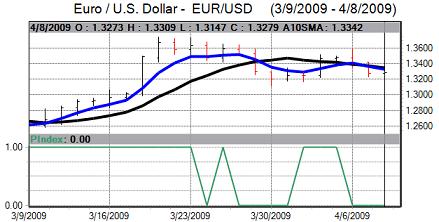

The Euro had a generally softer tone due to a lack of confidence in the economy, although there was still evidence of buying support at lower levels with some institutional support.

The Sentix business confidence index strengthened more than expected to -35.3 in March from -42.7 the previous month, but there was a larger than expected 0.6% decline in Euro-zone retail sales for February.

ECB member Bini-Smaghi suggested that intervention to influence currency values could be warranted, but that using currency rates to gain advantage could fuel protectionism. The comments may indicate that the ECB is becoming more uneasy over the risk of other major economies trying to boost competitiveness through deliberate currency depreciation. The comments also suggested that the ECB is on high alert over global exchange rate policies.

The Irish government was forced into an additional budget to tackle the severe fiscal deterioration as the economy contracts rapidly and this reinforced the fears surrounding the weaker Euro-zone members.

The headline German trade surplus was higher than expected, but there was a further decline in exports, the fifth successive monthly fall. Factory orders also continued to decline sharply for February which reinforced fears over the industrial sector and there was renewed unease over Eastern European economies.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The dollar was trapped in narrower ranges over the week with a lack of fresh incentives. Overall risk appetite was slightly weaker which triggered some defensive demand, but the dollar was unable to gain strong buying support as pessimism failed to dominate the markets. As liquidity dipped ahead of the Easter break, the Euro weakened back towards the 1.3150 level.

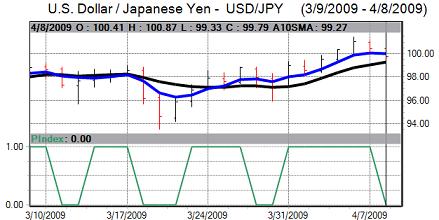

The Japanese yen weakened to six-month lows near 101.50 against the dollar and eight-month low against the Euro near 137.50 early in the week. Improved risk appetite triggered increased selling with evidence of a cautious return to carry trades. The Japanese currency secured some respite over the second half of the week as markets turned more cautious with the dollar consolidating just above the 100 level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The Bank of Japan left interest rates on hold at 0.10% following the latest policy meeting.The bank also announced that it would increase the range of collateral that would be accepted to boost market liquidity in a further attempt to ease credit strains.

UK manufacturing output fell by 0.9% for February which was slightly better than expected and triggered a small improvement in confidence as it suggested that the rate of decline was easing. The impact was still limited, especially as the manufacturing decline was still the worst for 40 years.

Consumer confidence edged down according to the latest Nationwide data while the NIESR estimated that GDP had fallen 1.5% during the first quarter, reinforcing expectations that the official data would show a very sharp decline. The goods trade deficit fell to GBP7.3bn for February from GBP7.8bn the previous month as exports recorded a modest improvement.

Underlying fears over government debt continued to be an important factor, especially with the UK budget due for release in two weeks time. The emergency Irish budget tended to increase fears that the UK fiscal situation will also deteriorate further.

Sterling pushed to highs near 1.50 against the dollar before retreating towards 1.4650 after hitting tough resistance. The UK currency also hit tough resistance beyond 0.90 against the Euro.

The Swiss currency resisted selling pressure against the Euro during the week and consolidated near the 1.52 region. The franc traded within narrower ranges against the dollar as cross-related moves cushioned dollar fluctuations with the dollar edging firmer to tackle resistance towards the 1.16 level.

The National Bank announced that Philip Hildebrand would replace Roth as Chairman from the end of 2009. Hildebrand has been vocal in his protests against Swiss franc strength over the past month and his appointment reinforced expectations that opposition to currency strength will continue over the remainder of 2009. Intervention fears continued to limit franc support.