Financial markets continued to take a generally optimistic stance towards the global economy over the week and this was a very important factor influencing direction for the major currencies.

There was a further narrowing of credit spreads during the week which boosted confidence and international risk appetite was also robust. The US dollar lost support and was particularly vulnerable against the commodity currencies.

Following a firmer manufacturing report last week, the US ISM index for the non-manufacturing index strengthened to 43.7 in April from 40.8 previously. This was a six-month high for the index and again above market expectations. The orders component strengthened with a limited recovery in the employment sub-index.

The US ADP employment report was also stronger than expected with job losses of 491,000 for April following a revised 708,000 decline previously. Although still severe in historic terms, it maintained optimism that the economy is stabilising.

Jobless claims were slightly stronger than expected with a decline to 601,000 in the latest week from 635,000 the previous week. Continuing claims were also slightly lower than expected, although they were still at a fresh record high. The employment data during the week increased optimism that the economy is starting to stabilise and there were hopes that the Friday payroll data would be stronger than expected.

Non-farm payrolls fell by 539,000 for April after a 699,000 decline for March while unemployment rose to a 26-year high of 8.9% from 8.5% previously.

Fed Chairman Bernanke repeated his recent cautiously optimistic comments with remarks that the economy is on track for recovery. He still warned that weakness would persist for some time while interest rates would remain at very low levels for an extended period.

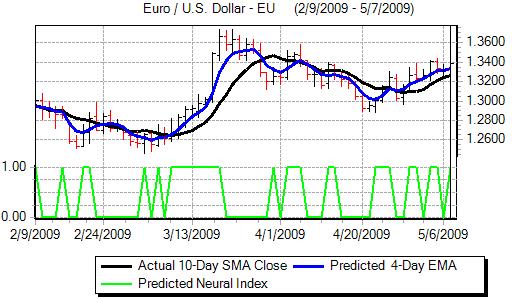

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Bernanke was also cautious over the banking sector and the stress-test results remained an important focus. The test results suggested that the main banks would need to raise additional capital of over US$70bn, but the market impact was limited as results had been leaked in advance.

In contrast to recent sessions, much of the Euro-zone data was actually weaker than expected with German retail sales falling by 1.0% for March for a 1.5% annual decline. In addition, the Sentix business confidence index only improved marginally to -34.3 in May from -35.3 the previous month. The German industrial orders data was stronger than expected with a monthly 3.3% increase which helped underpin sentiment, although there was still a 26.9% annual decline.

At the latest council meeting, the ECB cut interest rates to 1.00% from 1.25%. This was in line with market expectations and represented a record low for the ECB benchmark rate. The Euro initially rallied following the announcement as there was no immediate announcement over quantitative easing.

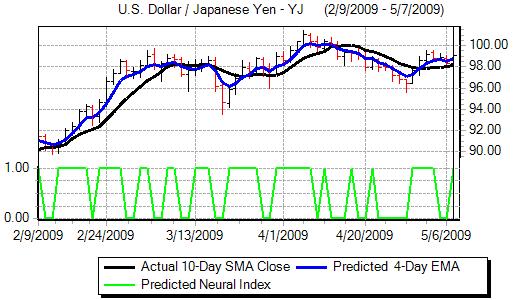

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

At the press conference, the ECB announced that in principal it would buy Euro-denominated covered bonds with purchases of EUR60bn. It will also continue with its enhanced credit-support approach for the remainder of the year. The ECB stated that these were measures to enhance market liquidity and were not quantitative easing.

The ECB measures drew a mixed response as there was some optimism that the bank was taking decisive action to support the economy, while the limited measures also helped maintain medium-term confidence in the currency.

The Euro recovered from initial losses against all the major currencies and the dollar weakened to 1.34 against the Euro. The Australian and Canadian dollars both gained to 7-month highs against the US currency with the Australian currency peaking above the 0.76 level.

The yen was unable to make any progress over week, primarily due to the significant improvement in global risk appetite. Trading was subdued in Asian hours with a series of Japanese holidays as part of the Golden Week holidays. The dollar continued to probe resistance levels above the 99.0 level against the yen.

The rise in the UK PMI index to 48.7 in April from 45.5 in March maintained a more positive short-term tone over the economy. The construction PMI index also rose to 38.1 in April from 30.9 previously which was the sharpest increase for close to 12 months.

As expected, the Bank of England left interest rates on hold at 0.50% following the latest monetary meeting. The bank also announced that it would expand the quantitative bond-buying programme with an additional GBP50bn of buying once the GBP75bn of buying has been completed under the existing programme.

The move towards additional quantitative easing will represent an important medium-term risk for the currency with fears over the underlying threat of higher inflation. In response, the UK currency weakened back to near 1.50 against the dollar from a high near 1.52 and also dipped sharply to 0.89 against the Euro from highs around 0.8760.