.jpg)

One of the main challenges of a beginning investor is discovering what is important to learn so you can be successful trading stocks.

There is a multitude of information to be explored. Some of the techniques and ideas can be overwhelming, or confusing. In this article we’ll discuss the fastest way to realistically learn about stock trading and the things you need to focus on that could help you find success over the long term.

1. Open a Brokerage Account, Paper Trade for 6 Months

50 years ago, beginners were advised to paper trade. This meant to record all your trades in a notebook. Today with the advent of online brokers all you need to do is open an account and you can begin hypothetically trading the stock market with real time simulated trades. Paper trading is basically practice trading or trading with virtual money. When you open a paper trading or demo account with a broker, you’re taking no monetary risk. Paper trading lets you study the market and practice without losing or making any money. We advise all new traders to paper trade for 6 months to demonstrate profitability before moving to real time trading.

One of the great aspects of paper trading is that you can get a real feel for the markets. You can also make all of the mistakes in the world and learn from them without actually having to suffer any of the financial consequences.

Traders need to learn to coexist peacefully with the emotions of greed and fear. Unfortunately, paper trading doesn’t engage these emotions, which can only be experienced by actual profit and loss. But paper trading will teach you how quickly money can be made or lost based upon your decision-making process.

2. Learn Risk Management

The biggest mistake that beginning traders make is that they trade too large. Most traders are so hungry to make money that they look at the stock market as an exit path from the 9 to 5 job grind. The problem with this perspective is that great trading is never measured by how much you make when you are right. Instead, it is measured by how little you lose when you are wrong. The only way you can understand this statement is by recognizing that the most important aspect of trading is not market selection, but rather money management. In other words, how much risk are you taking on each trade?

To understand this principle, I want you to imagine that you are granted access to sit in on the trade selection meetings from the top hedge funds in the world. Imagine for a moment, that as you sit among this elite group of traders as they discuss their best trading ideas, what do you think is the biggest ongoing challenge they face?

The answer is risk management. How much are they willing to commit to one particular stock. When you study the holdings of any great trader, hedge fund or ETF you will quickly come to discover that they rarely will commit more that 2% of their entire fund to any one trade.

Stop and think about that!

Why? Imagine that you have a $100,000 account and you commit $2,000 to one stock. What happens if the stock goes bankrupt? You lost $2,000. But more importantly, you lived to trade another day and with your remaining $98,000 you can quickly regain that loss.

What every great trader in the world has had to learn is that the most important aspect of trading is learning how to protect your bankroll. Instead of focusing how much you might make on any given trade, it is critical to instead focus on defense. How much will you lose if you are wrong? The importance of this tactic cannot be overstated. It is the secret that allows small traders to become big traders. It is how big traders become bigger traders. It is the most important aspect of trading.

Instead of focusing on how much money you will make, instead place your focus, energy, and attention on not losing money. You can effectively accomplish this goal by following what the large hedge funds do. Always prioritize risk management.

3. Study Charts

Charts are quite literally the footprints of what everybody in the world knows about a particular asset. It is vitally important that you learn how to read a chart and study how trends develop, mature, and eventually end. There are many services online where you can study the long-term charts of whatever assets you are interested in trading.

We advocate that before a trader takes any position in any market that they have followed the trend and know where the market is trading in relation to its 52-week high and low. Beginning traders often try to buy low and sell high. While this can work, you also need to find strong powerful trends and learn to surrender to them. In other words, you need to buy high and sell higher.

Our suggestion is to make it a priority to study charts. As you do this, to really maximize your time, specifically study the great trends that have occurred in the financial markets and learn to recognize when the charts are talking and more importantly when they are silent. Charts remind traders that you are only one trade away from life changing income.

Great traders know how to read a chart. Seeing a trend forming and maturing is a very exciting and profitable endeavor to master.

4. Manage Your Emotions

Emotional trading is a problematic area for new traders. It is not uncommon for a new trader to find information that disagrees with their previous analysis which forces them out of a trade early. It is vital that traders learn to differentiate emotional judgments from rational decision making. The markets are filled with noise and great traders have to learn to block the noise with a systematic method that suits their personality and risk tolerance. This reality is also why sound risk management is essential.

5. Read the Classic Trading Books

Literacy and expertise go hand in hand. If you want to be a great trader and are serious about the financial markets, we strongly advise that you acquire the top trading books and study them regularly. It’s important not to focus too narrowly on one single aspect of trading. Instead, study everything broadly. Trading launches an adventure that ends at a destination not anticipated at the starting line. Your broad and detailed market background will come in handy over and over again, even if you think you know exactly where you’re going right now.

Here are nine “must-read” books for every new trader. If the title is highlighted in a blue hyperlink, we have reviewed it previously in a recent section of this blog and would encourage you to read our review.

- Stock Market Wizards by Jack D. Schwager

- Trading for a Living by Dr. Alexander Elder

- Reminiscences of a Stock Operator by Edwin Lefevre

- Technical Analysis of the Financial Markets by John Murphy

- Winning on Wall Street by Martin Zweig

- The Nature of Risk by Justin Mamus

- Unknown Market Wizards by Jack Schwager

- What I Learned Losing a Million Dollars by Jim Paul and Brendan Moynihan

- When Genius Failed by Roger Lowenstein

News sites such as Yahoo Finance, Google Finance, and CBS MoneyWatch serve as great resources for new traders. For more sophisticated coverage, you need to look no further than The Wall Street Journal and Investors.com

6. Other Ways to Learn and Practice Trading

Don’t forget about additional education as you proceed on your trading career. Attend more specialized seminars which are often conducted by professional traders. These events can provide valuable insight into market strategies and tactics. If you are, or become, a Vantagepoint Family Member, we have a number of live seminars and educational online sessions you can take advantage of.

Should you choose to dig into a company’s fundamentals, you can find wonderful resources for free available at your local public library. Many libraries subscribe to the Value Line Investment Survey which consists of professional research and recommendations on approximately 1,700 stocks. According to Value Line, this represents “… approximately 90% of the trading volume of all stocks.” Value Line provides an easy way to start your research.

7. Use Powerful Software and Technology

Many of the popular indicators that are available today were created in the 1970’s before the development of the personal computer. The tools you use to filter and select markets will have a huge impact on your bottom line. Today the most powerful cutting-edge technologies used by big tech companies are artificial intelligence, machine learning and neural networks. These tools have proven to be very successful in keeping traders on the right side of the right market at the right time.

Time is the one scarce resource that we all have. The reality is that doing proper analysis of financial markets can be very time consuming. There are literally hundreds of numbers, articles, news stories and charts to review before we can apply that information to our decision-making process. Wouldn’t it be wonderful if there was a software package that simplified this process and provided world class accuracy as well?

There is. It’s called VantagePoint A.I. Software.

Using artificial intelligence, machine learning, neural networks, and intermarket analysis it concisely summarizes the strongest trends in the marketplace and provides a risk/reward framework that is up to 87.4% accurate in determining short term forecasts.

A picture is worth a thousand words.

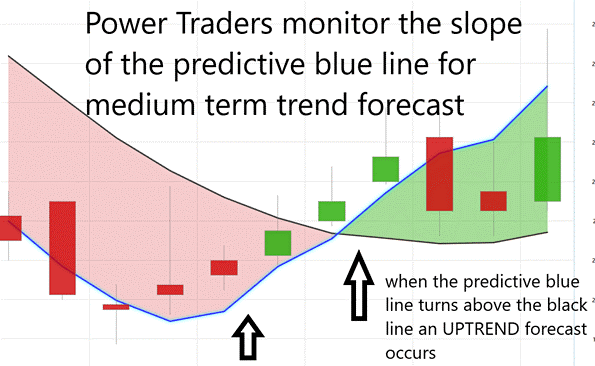

The key to the VantagePoint analysis is the predictive blue line. The slope and general direction of the blue line determines the medium forecast for the market.

The Vantagepoint Software has three separate modules which create a forecast for a Power Trader. They are the predictive blue line, the Neural Net, and the Intermarket Analysis.

The predictive blue line also acts as value zone where in uptrends traders try to purchase the asset at or below the blue line. Power traders use the predictive blue line in helping to determine both the value zone as well as the trend direction.

To understand and appreciate how powerful this indicator is, let me show it to you without any of the daily price bars on the chart.

- The slope of the predictive blue line determines the short-term trend. On the following graphic, monitor that you would want to buy when the slope of the blue line is going up.

- When the slope of the blue line is going sideways you would be anticipating sideways prices.

- Likewise, when the slope of the blue line is going down you would be anticipating lower prices.

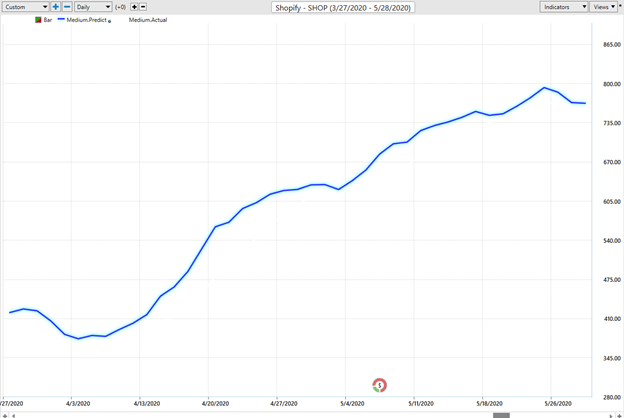

Look at how simple this is to interpret and understand. The blue line is tracking and monitoring the price action of SHOPIFY (SHOP) last summer.

Over a period of 45 days prices more than doubled. Here is the chart of SHOP with the actual price bars included. On April 7, 2020 Shop closed at $378.54. Only six weeks later it traded as high as $844.

Traders using artificial intelligence and machine learning allowed the predictive blue line to define when the trend was accelerating, maturing and ending.

This is the power of artificial intelligence in action.

This is what makes Artificial Intelligence so unique.

Machine Learning is designed to learn from experience and make the best statistically relevant decision moving forward. AI outperforms humanoid analysis hands down every time.

We live in very exciting times.

Since artificial intelligence has beaten humans in Poker, Chess, Jeopardy and Go! do you really think trading is any different?

Are you capable of finding those markets with the best risk/reward ratios out of the thousands of trading opportunities that exist?

Knowledge. Useful knowledge. And its application is what A.I. delivers.

Artificial intelligence is not “a would be nice to have” tool.

It is an “absolutely must have” tool to flourish in today’s global markets.

Intrigued? I invite you to learn more about how artificial intelligence, machine learning, neural networks and intermarket analysis can help you find your next great trade.

Please visit with us at our – Next Free Live Training.

It’s not magic. It’s machine learning.

Make it count.

IMPORTANT NOTICE!

THERE IS SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.